Cleveland-Cliffs Inc. (CLF) is the largest flat-rolled steel company and the largest iron ore pellet producer in North America. Our “Strong Buy” view is driven by CLF’s competitive advantage in producing steel for automotive markets, writes Matthew Miller, analyst at CFRA Research.

CLF has a strong focus on maximizing return on invested capital and unlocking value for shareholders. We think CLF has been proactive with its Hot Briquetted Iron (HBI) facility, a project that generates strong returns on investment and improves CLF’s ESG metrics. CLF is a misunderstood story and we see CLF as the most compelling name in the industry.

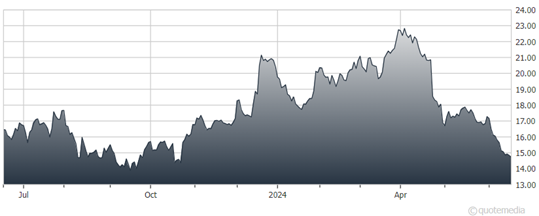

Cleveland-Cliffs Inc. (CLF)

Our 12-month target of $24 values CLF shares at an EV/EBITDA of 6.5x our 2024 EBITDA estimate, a premium to CLF’s three-year average forward EV/EBITDA of 4.7x, but a discount to peers. CLF is insulated from the potential impact of higher costs for metallics, given its internally sourced iron ore pellets and HBI.

We think CLF is in a great position to restart a dividend (and continue to buy back shares), which we think would be a positive catalyst. Risks to our outlook include weaker economic conditions in North America (especially automotive OEM build rates or nonresidential construction), lower steel prices, and higher input costs.

Recommended Action: Buy CLF.