May's retail sales, including food services, rose just 0.1% month-over-month, weaker than expected. But that's in current dollars. Adjusted for inflation, they were not as weak. CPI goods fell 0.1% m/m during May. So, real retail sales, less food services, rose 0.3%. Much of the recent weakness in retail sales has been in housing-related merchandise since housing sales remain weak, writes Ed Yardeni, editor of Yardeni QuickTakes.

The real retail sales indicator has stalled in recent months, but remains on its pre-pandemic uptrend (chart below). Nevertheless, the Atlanta Fed's GDPNow tracking model currently shows real consumer spending (on both goods and services) rising at a seasonally adjusted annual rate of 2.5% during Q2. That’s down slightly from the previous estimate of 2.8%. The model is tracking Q2's real GDP at 3.1%.

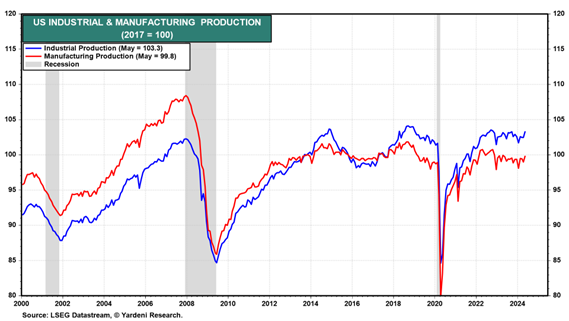

Meanwhile May's industrial production jumped 0.9% m/m. Manufacturing output also rose 0.9%. Among the strongest industries were appliances and furniture (3.9%), petroleum and coal products (2.8%), chemical products (1.9%), textile and product mills (1.6%), durable goods (1.3%), defense and space (1%), and information processing (1%).