The Federal Reserve met, and the Fed decided…to do nothing. Policymakers held the key federal funds target rate range at 5.25%-5.50%, first set back in July last year. As for the “dot plot,” though it has a lousy track record, it suggests only one rate cut is coming this year. But make no mistake, this continues to be an ideal environment for gold and silver, explains Peter Krauth, editor of Silver Stock Investor.

In his post-meeting press conference, Chair Jay Powell didn’t even offer guidance on rate cuts, only saying that the Fed remains data dependent. Policymakers need “greater confidence” that inflation is easing. For now, it seems inflation is stuck in the 3.3%–3.5% range, above last year’s level of 3%, while the Fed’s "official" target remains 2%.

I’ve said it before, and I’ll repeat it. I expect the Fed will eventually raise its inflation target from 2% to 3%, and that other major central banks will follow suit. That will take some pressure off policymakers, and help the Treasury repay its impossible debts with inflated dollars.

After the Fed meeting, both gold and silver initially rose, then sold off over the next few days while markets digested the idea that a rate cut may be delayed. No surprise, as a rate cut would have weakened the dollar. Instead, the dollar rose, creating headwind for the metals.

But what’s next? I think we’ll see the dollar maintain some strength. As a result, I think silver will consolidate or potentially weaken a little as the summer progresses. Yet I view that as an opportunity for anyone who missed its dramatic run up from $22 to $32 in recent months.

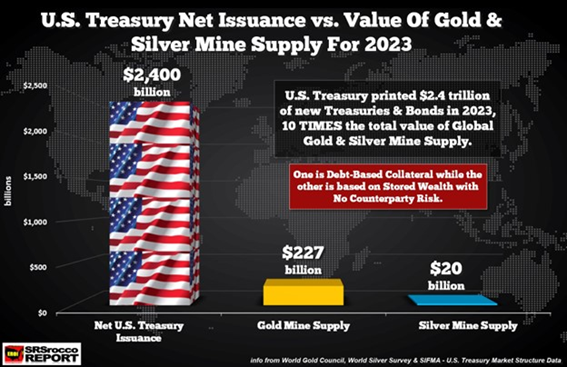

As this chart from SRSrocco Report demonstrates, in 2023 alone, the US Treasury printed $2.4 trillion. That was 10 times the value of the total mine supply of gold and silver.

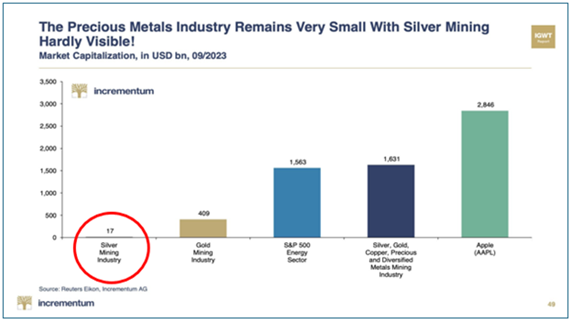

And as this chart from Incrementum shows, the size of the entire silver mining industry is hardly even visible when compared to the gold mining industry, the S&P Energy Sector, the combined precious metals, copper and diversified metals mining industry, and big tech names like Apple Inc. (AAPL).

The takeaway here is that when the crowd starts stampeding towards silver and silver miners, the action of the last three months will look like a quiet Sunday stroll in the park.

Recommended Action: Buy silver and silver miners.