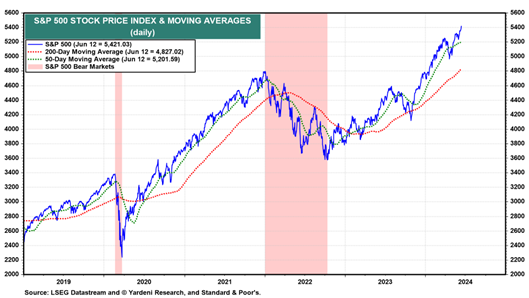

Hooray! The S&P 500 closed slightly above our year-end target of 5,400 earlier this week. The same thing happened to us last year: We were forecasting 4,600 by the end of 2024 and got there by mid-year. The index closed around 4,800 at the end of last year. “So, what do we do now?” asks Ed Yardnei, editor of Yardeni QuickTakes.

We’ll talk and write more about our 2025 and 2026 targets of 6,000 and 6,500, on the way to 8,000 by the end of the Roaring 2020s decade. Bottom line: It's still a bull market.

Now, let's review the bullish inflation news:

1) Headline and core inflation. May's headline CPI inflation rate was zero month-over-month and 3.3% year-over-year. The core CPI inflation rate rose 0.2% m/m and 3.4% y/y, the lowest reading since April 2021. Excluding shelter, headline and core CPI inflation rates are now at 2.1% and 1.9% y/y.

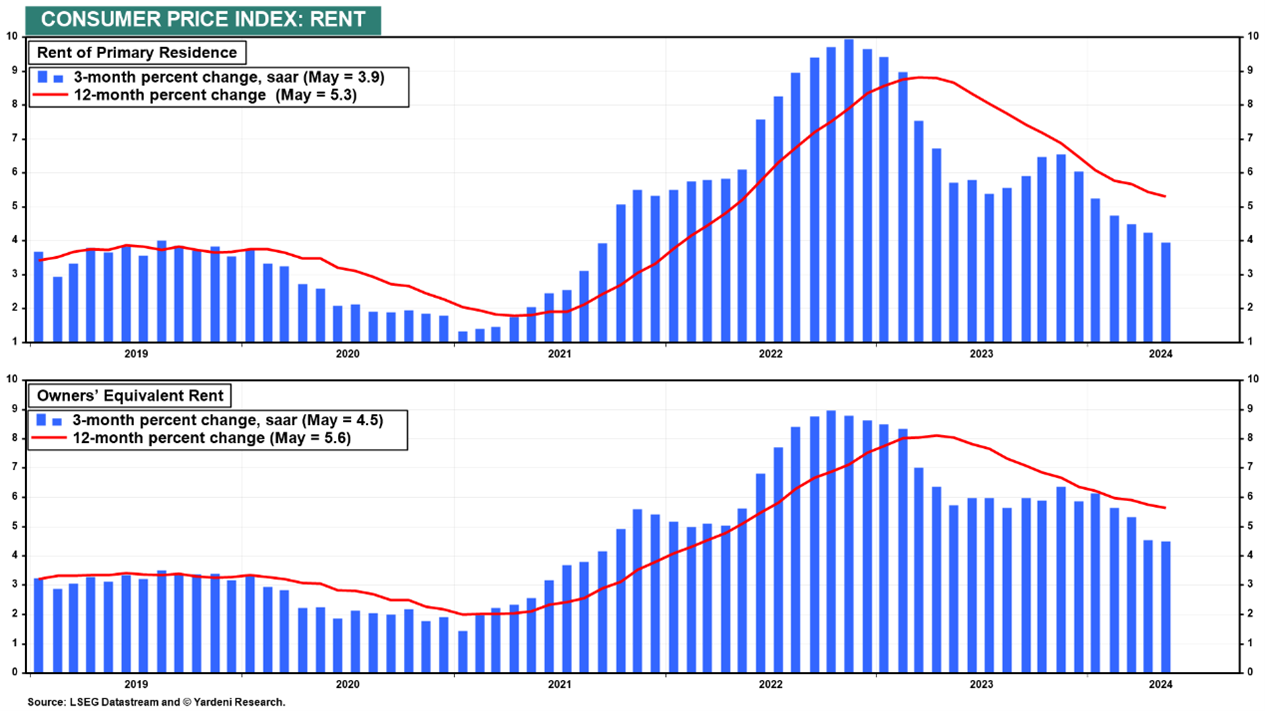

(2) Rent inflation. The two major rent components of the CPI are continuing to moderate, with their three-month annualized increases well below their y/y rates (chart below).

(3) Goods inflation. The CPI durable goods price index is deflating again as it did prior to the pandemic. The prices of consumer goods imported from China are falling. The CPI nondurable goods price index, which includes food and energy, was up just 1.8% y/y during May. Gasoline prices have been falling in recent weeks.