It's not a bad thing for America, Americans, or the American stock market that the largest companies in the country are going up in price. The best players are scoring a lot of points. That's perfectly normal. In fact, if you go back and study every bull market over the past 100 years, you'll notice that technology is a leader in almost every single one of them, writes JC Parets, founder of AllStarCharts.com.

Tech stocks doing well, and outperforming other sectors, is just a classic characteristic of a bull market.

The 2-year anniversary of this bull market is coming up this Sunday on June 16. That’s when the new lows list peaked at the end of the last bear market that first got going back in 2021.

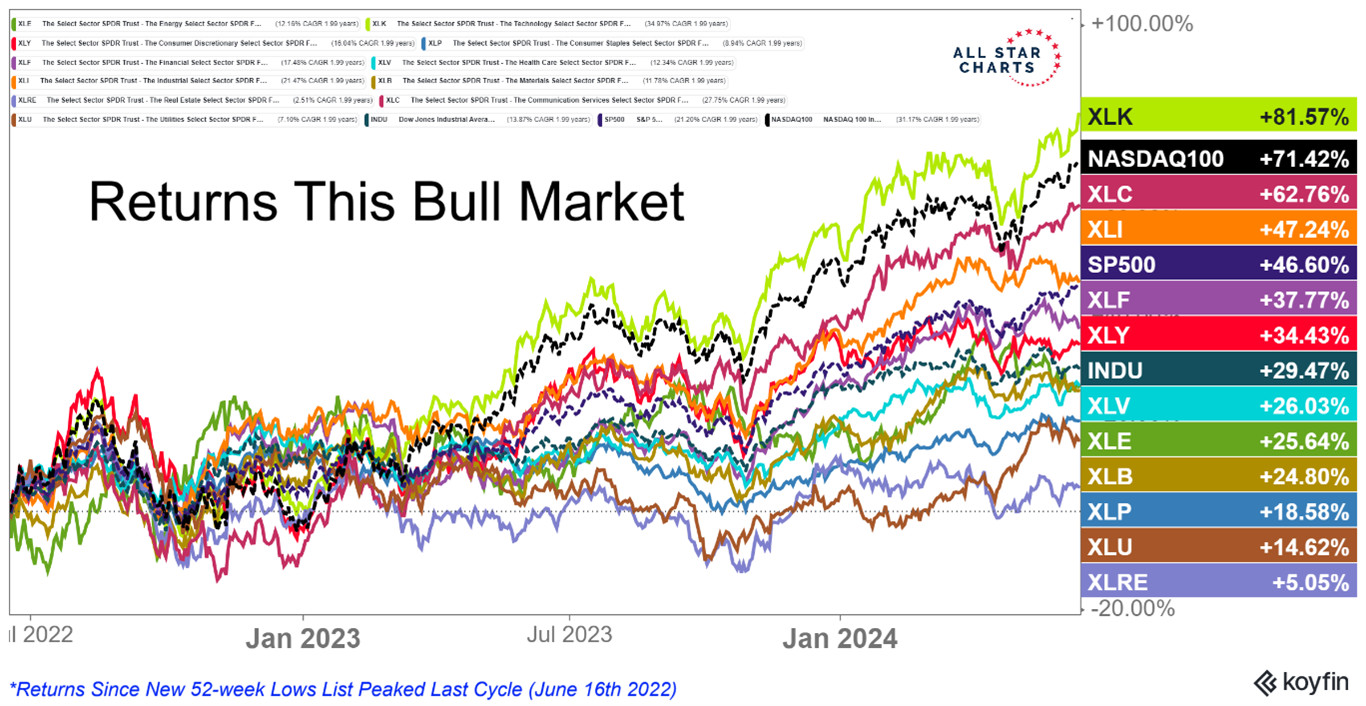

Here...look for yourself. These are the returns for every sector going back to the beginning of this bull market:

Technology is a standout leader. But Communications and Industrials are rounding out the top three. Then Financials and Consumer Discretionary represent the rest of the top five.

These are the types of sectors you would expect to see leading during bull markets. More defensive areas like Real Estate, Utilities, and Consumer Staples underperforming is also perfectly consistent with other bull markets from the past.

There are opportunities to buy stocks here. The question people are asking is: Sure, but which ones?