American Financial Group Inc. (AFG) is a holding company based in Ohio and founded in 1959. But its insurance roots go back to 1872. It pays steadily growing quarterly dividends and also rewards investors with supplemental payouts, advises Tim Plaehn, editor of Monthly Dividend Multiplier.

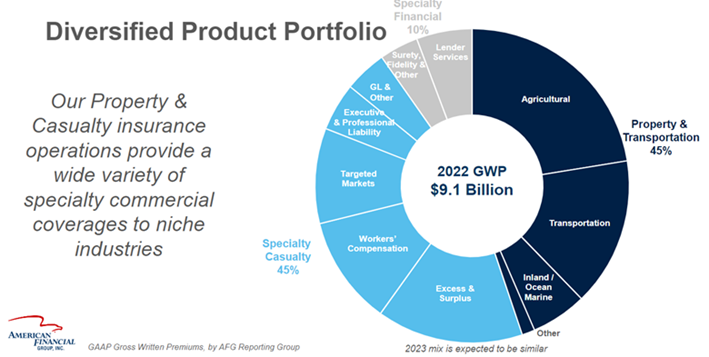

Today, through the operations of Great American Insurance Group, AFG is engaged in property and casualty (P&C) insurance, focusing on specialized commercial products for businesses. AFG’s Specialty P&C Group is comprised of over 30 diversified businesses offering a wide range of specialty commercial coverages in three major groupings: Property and Transportation, Specialty Casualty, and Specialty Financial.

A history of acquisitions and dispositions has left AFG with a number of profitable niche insurance lines.

Out of the twelve largest property and casualty insurance companies, American Financial Group has posted the highest pretax P&C returns for the last one, five, 10, and 15-year periods. Written P&C premium should continue to grow steadily, with renewal rates growing 8% for 2024.

What excites me most is the potential for higher returns from the investment portfolio. As of the end of March, the fixed-income investments have carried an average annualized yield of 4.93%, up from 4.68% at the end of the 2024 third quarter. The first-quarter earnings report noted that the combination of dividends paid, plus book value appreciation, totaled 5.6%. This earnings level results in a core return on equity of approximately 20%.

American Financial Group has grown its regular dividend by 12% annually over the past decade. The dividend has grown for 18 consecutive years. The dividend increased by 12.7% in October. The current yield on the regular dividend is 2.2%.

The AFG regular dividend has grown for 18 consecutive years. The five-year average annual growth rate comes in at 12%. And the company also pays special dividends.

Three dividends totaling $12 per share were declared in 2022. AFG paid five special dividends, totaling $26 per share, in 2021. For 2023, a total of $5.50 was declared across two supplemental dividends. This year, a $2.50 supplemental dividend was paid in February.

Recommended Action: Buy AFG.