Gold and silver both nose-dived last Friday thanks to a surprisingly good jobs report and news that China didn’t buy gold in May. Both rebounded a bit, but the status of central bank buying (and the People’s Bank of China specifically) going forward remains a big question mark, says Brien Lundin, editor of Gold Newsletter.

As gold was undergoing its most severe beating in three years on Friday, there were few questions over what precipitated the selling. In fact, there were two clear reasons for the sell-off.

The first was the nonfarm payrolls report for May, which came in at a surprising 272,000, nearly 100,000 jobs higher than the consensus expectation. The second was the news that China stepped aside from publicly acknowledged gold purchases in May (who knows what they might have done on the sly, however).

The result: Gold fell off a cliff, and the decline gained steam during the session as sell-stops were hit. Gold finished down $83.40 at $2,292.60 bid, while silver shed an amazing $2.14 to $29.13. The losses were about 3.5% and 6.8%, respectively. It was a slaughter, though we have recovered somewhat since then.

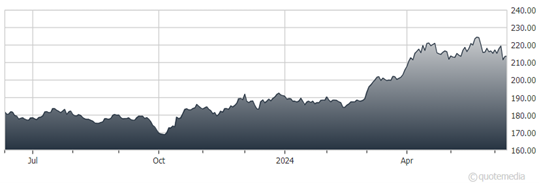

SPDR Gold Shares ETF (GLD)

Regarding the first hit to gold on Friday, that jobs number was stunning...but it was far uglier once you dug into the details. Not only did the household survey show a loss of 408,000 jobs, but the jobs that were gained in the employer survey were of low quality.

So despite the market interpretation that the positive beat on jobs would further postpone the Fed’s pivot, the deeper data showed anything but good news for the economy. As I have pointed out, the spiraling costs of servicing massive debt loads by the federal government and corporations are going to force the Fed to pivot. They are actively looking for any excuse to do so, even as their central banker brethren are already cutting.

Now, the fact that the People’s Bank of China stepped aside from the gold market last month is more concerning to me. Granted, a number of other central banks continued their purchasing programs. But the PBOC and domestic Chinese demand have been the top two drivers (that we’ve been able to identify) for the current gold bull run.

Unless we see the PBOC return in force this month, I’ll be a little worried about this catalyst continuing to drive the bull forward until the Fed pivot kicks in. The good news, as I mentioned above, is that a number of buyers, perhaps including the PBOC and maybe some of those mysterious investors out there, didn’t hesitate to take advantage of Friday’s price drop.

I firmly believe that the Fed will be forced to begin cutting rates in the not-too-distant future. This is the big factor that we were expecting to drive the gold price higher this year...and everything else that came into play so far has been a big surprise. So, the future still looks bright.