Not long ago, brick-and-mortar businesses dominated the global economy. However, the invention of the microprocessor in the 1970s, followed by the internet and World Wide Web in the 1980s, set the stage for two groundbreaking technological paradigms: The microcosm and telecosm. Among the pioneers in capitalizing on the potential of digital transformation is Magic Software Enterprises Ltd. (MGIC), an Israeli-based company, writes George Gilder, editor of Gilder’s Moonshots.

The microcosm refers to the miniaturization of electronic components, enabling the development of powerful, compact devices. The telecosm, on the other hand, represents the vast network of interconnected devices and information made possible by the Internet.

The rise of these paradigms revolutionized the way people worked and conducted business, leading to a profound shift from traditional brick-and-mortar establishments to digitally driven enterprises. This digital transformation has reshaped industries, creating new opportunities and challenges, and forever altering the landscape of commerce.

Today, MGIC is a leader in cloud technology and managed services engineered to enable businesses to adopt digital transformation. The company’s suite of tools and services helps organizations to streamline operations, enhance efficiency, and unlock new growth opportunities in the digital age.

Magic's software-based managed services — NOC-as-a-Service (Network Operations Center as a Service), SOC-as-a-Service (Security Operations Center as a Service), DevOps-as-a-Service (Development and Operations as a Service), and FinOps-as-a-Service (Financial Operations as a Service) — collectively allow organizations to focus on their core competencies while outsourcing chunks of their IT operations to specialized providers.

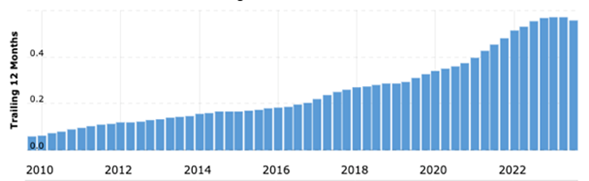

In the company's most recent earnings report, Magic's management highlighted signs of recovery as the macroeconomic environment improves and new growth opportunities emerge. In light of these positive developments, the company reaffirmed its annual revenue guidance for 2024, projecting a range of $540 million-$550 million, injecting reasons for optimism. With a strong foundation in software-based managed services and a track record of adapting to market demands, Magic is indeed positioned to benefit from the re-energized digital transformation trend.

In terms of its financial metrics, Magic’s stock is attractively valued, trading at a forward P/E of 14.3, considerably less than the Russell 2000 market comp forward P/E of 24.9. Additionally, the company offers a dividend yield of 3.15%, providing investors with a supplementary fixed income stream.

Recommended Action: Buy MGIC.