Markets go up and markets go down. Overall, as dividend investors, our stocks are stable through it all. We collect our dividends like clockwork. But you might have missed a piece of very important news. It changed the workings of the entire market. And it will affect whether or not you are eligible for your dividend payments, explains Kelly Green, editor of Dividend Digest.

The Memorial Day weekend marked a shift in how the market functions. Prior to then, the stock market operated using a T+2 settlement model. The “T” stands for transaction or trade date. The “plus 2” indicates the settlement date — the date the trade becomes official — is two trading days later.

This has been the market standard since 2017 when it was shortened from T+3. That happened again last week. Now the settlement standard is officially T+1. This applies to stocks, bonds, ETFs, certain mutual funds, municipal securities, REITs, and MLPs. All these securities must be settled by the end of the next business day.

The market is finally catching up with technology and investor need. Most investors won’t notice the change, even though it applies to every stock trade. But the main reason I’m writing you about this change is what it means for our dividend stocks. Specifically, how to know if you’re eligible or not to receive your dividends.

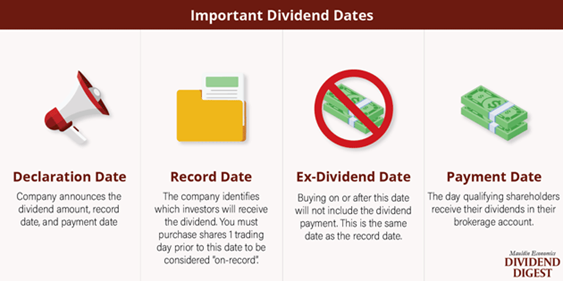

There are four important dates that dividend investors should know. It starts with the Declaration Date. That’s when the company announces the amount of the next dividend, the Payment Date, and the Record Date.

The Payment Date is just that, the date the dividend will hit your account. The Record Date tells us if we are eligible to receive the payment. Your trade must be settled by the record date to qualify.

Under the prior T+2 settlement, you needed to purchase your dividend stock at least two days prior to the record date. The day before the record date was the Ex-Dividend Date. It was the first day you would not be eligible to receive the dividend as the trade would have settled after the record date.

Understanding the new Ex-Dividend Date ensures you know if you are eligible for the dividend. Plus, the share price usually drops on this date by the amount of the dividend. So, this can help time when to buy or sell a dividend stock.

The new T+1 settlement lets you buy a stock up to the day before the record date and still receive the dividend. The Record Date and the Ex-Dividend Date are now the same. Here is a graphic for handy reference.

We all love to see those dividends hit our accounts month after month or quarter after quarter. Just make sure you understand the new settlement rules so you get every payment you expect and deserve.