The market has leveled off since the middle of May. I expect more of the same going forward. In sideways markets, income is king. Dividends and covered call premiums ring the register while stock prices flounder. I like Alexandria Real Estate Equities, Inc. (ARE), counsels Tom Hutchinson, editor of Cabot Income Advisor.

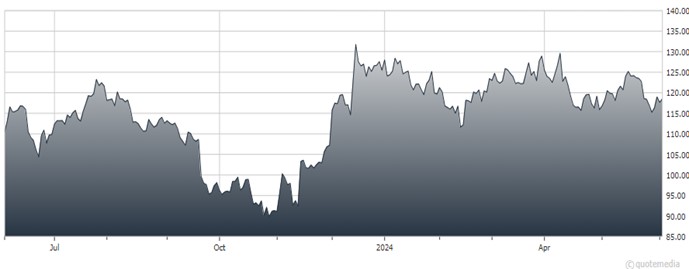

The S&P 500 pulled back in early April after a five-month rally because sticky inflation soured the interest rate narrative. The index then recovered to new highs in the middle of May on an improved interest rate outlook.

But stocks have since leveled off as the interest rate outlook got stuck in the mud. This is where we are. It’s a tug-o-war between Fed rate cut hopes and the possibility that no rate cuts will come this year.

It will take major news to resolve this standoff. But I don’t believe that kind of resolution is likely in the next several months. Therefore, in the absence of other market-moving events, the market is likely to be a lot more sideways going forward than it has been over the last six months.

Alexandria Real Estate Equities Inc. (ARE)

As for ARE, its shares yield around 4.3%. The recent good interest rate news hit a wall over the past couple of weeks. After bouncing around with the interest rate narrative for the past few years, this one-of-a-kind life science property REIT was having a good month in May. But it gave up most of the gains.

This is a solid REIT that reported strong earnings and raised the dividend in the last quarter. ARE will likely bounce around somewhat at the mercy of the interest rate narrative and not significantly surge higher until rates muster a sustained move downward.

Recommended Action: Buy ARE.