I like to buy when no one cares, or flat-out hates, real estate. That is precisely the environment right now. The only asset class that is hated more than real estate is banking. VICI Properties Inc. (VICI) is one of the world’s highest-quality collections of real estate and you should consider it, recommends Tim Melvin, editor of The 20% Letter.

As Warren Buffett once pointed out, it is better to get things mostly right instead of precisely wrong. I can be fairly certain that high quality real estate will outperform the major stock market indexes over the next seven to ten years.

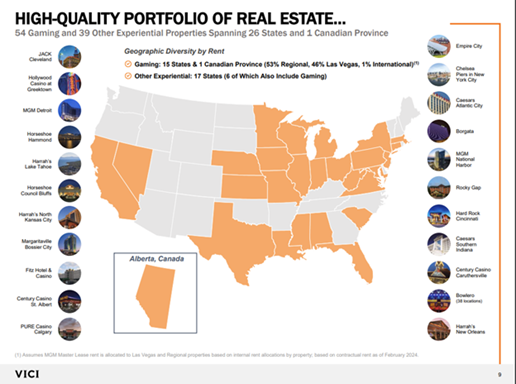

VICI should benefit. This REIT owns 54 casinos across the United States, including some of the best-known hotels and casinos on the Las Vegas Strip. VICI’s properties contain over 60,000 hotel rooms, 4.2 million square feet of casino floor space, 6.7 million square feet of convention and meeting space, 400 places to eat and drink, 500 retail outlets, and four golf courses.

Management knows it needs to expand, and the REIT has been acquiring other destination real estate outside of Las Vegas. Last year, they closed a sale leaseback deal with Bowlero, adding 38 bowling entertainment centers to the portfolio. It also acquired the leasehold interest in Chelsea Piers in New York City for $342.9 million.

VICI made development loans for other projects, including a water park in Virginia, a Margaritaville Resort in Kansas City, several Great Wolf Resorts, Canyon Ranch Wellness Resort facilities in Texas and Arizona, and three high-end Cabot resorts.

This is more than just a REIT. VICI Properties is a great business. Best of all, it’s at a bargain price, thanks to the current investor distaste for real estate. A conservative estimate of VICI’s current value per share is roughly $45, or about 50% above the current share price. The dividend yield is around 5.5%, and the payout has increased by more than 7% annually since the REIT was founded.

Recommended Action: Buy VICI.