We are raising our rating on Goldman Sachs Group Inc. (GS) to “Buy” from “Hold” following 1Q results, which demonstrated the considerable strengths of the Goldman franchise during an investment banking upturn. The environment offered a few false rebounds in 2023, but the current surge appears to have staying power, suggests Stephen Biggar, analyst at Argus Research.

Equity and debt underwriting showed good sequential improvement, and industry-wide announced M&A deal value in Q1 climbed in the high-teens year-over-year. That should produce improved revenues in the second half of the year.

Data from SIFMA shows a triple-digit year-over-year rise in capital formation in the first quarter, with the value of IPO issuance up 239% and secondary issuance up 110%.

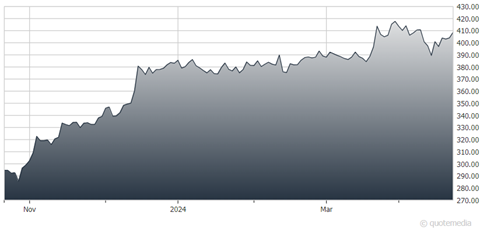

Goldman Sachs Group Inc. (GS)

Goldman held its most recent Investor Day in February 2023, about three years after its first-ever Investor Day in January 2020. The company provided updates to previous financial targets including a through-the-cycle goal of 14%- 16% for return on equity (up from greater than 13%), 15%-17% for return on tangible common equity (up from greater than 14%), and an efficiency ratio of around 60% (unchanged).

Key priorities include maximizing wallet share and growing the financing business within its Global Banking & Markets segment, growing management fees within its Asset & Wealth Management segment, and scaling and achieving profitability in its Platform Solutions segment.

Goldman is placing an emphasis on its Asset & Wealth Management unit as a growth driver. Amid continued losses, the company has pared back expectations for its consumer strategy. In early 2023, it announced the sale of a portion of its Marcus consumer loan portfolio. In late 2023, it sold its GreenSky consumer loan platform and its General Motors (GM) co-branded credit card program.

While deposit gathering has been successful, and particularly helpful as the firm was at a disadvantage to peers with lower-cost funding sources, we believe that the aggressive push into consumer lending segments was ill-timed. The company built considerable lending portfolios just ahead of a downturn in credit quality.

We have noted Goldman was not time-tested through a consumer credit cycle and was at risk of higher-than-peer default rates as the portfolio rapidly expanded. With a refocus on strengths across capital markets, and an expected durable upturn in investment banking, we look for the company’s financial metrics to improve. Our near- and long-term ratings are now “Buy.”

Recommended Action: Buy GS.