Gold miners lagging the price of gold is a compelling buying opportunity. Gold equities provide leverage to the gold price, as a large percentage of gold miners’ total costs are fixed costs. Therefore, as the price of gold goes up, gold miners’ profits and cash flow should increase at a higher rate than the price of the underlying bullion price, advises Matthew Miller, analyst at CFRA Research.

This levered exposure to gold is generally good during periods of gold appreciation, and the opposite is true during periods of weakness in the gold price. During the last year, however, gold miners have dramatically underperformed the bullish move in the price of gold.

Gold equities started to perform as expected in the month of March, but we think gold miners are poised to significantly outperform over the next 12 months. We anticipate gold miners finishing 2024 with an appreciation that is well above the price movement of the underlying gold price.

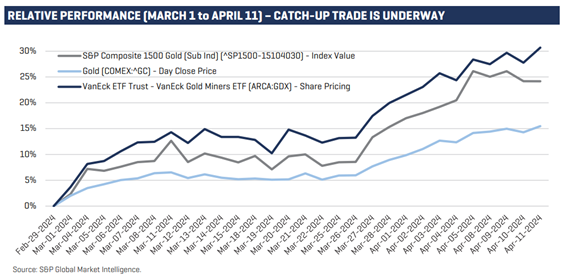

The catch-up trade has already started but has significant upside from here. From March 1 to April 11, gold equities were performing as they should, as the S&P Composite 1500 Gold index was up 24.2% during that period, while the VanEck Gold Miners ETF (GDX) was up 30.7%. That far outpaced the move in the gold price, which appreciated 15.5% during the same period.

Investors might think it’s too late. But we think the catch-up trade has much more room to run, with important positive catalysts likely during the Q1 and Q2 2024 earnings season and when the Federal Reserve and other central banks pivot back to accommodative policy.

So, what has held mining shares back? We think investors are skeptical of the recent gold bull run and are worried about miners’ rising costs. Costs are up significantly for gold miners in recent years. But we think cost inflation is largely behind them and that most major miners will likely guide operating costs at flat to up low-single digits in 2024.

That means that nearly all of every incremental dollar from selling ounces of gold at higher prices will drop to the bottom line. In fact, royalties and streaming companies Franco-Nevada Corp. (FNV), Royal Gold Inc. (RGLD), and Wheaton Precious Metals Corp. (WPM) have zero incremental operating costs when the gold price increases.

We think when gold companies report their Q1 and Q2 earnings, cost guidance will provide positive catalysts, as gold miners are likely to guide to strong margin expansion.

Recommended Action: Buy gold miners.