Software giant Salesforce Inc. (CRM) was in the spotlight earlier this week, falling sharply on reports that it’s in talks to buy Informatica Inc. (INFA). The AI-powered cloud data management company is worth roughly $10 billion and would be Salesforce’s largest acquisition since buying Slack for $28 billion during the height of the pandemic, notes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Neither company commented on the reports, but the market shot first and asked questions later (as usual).

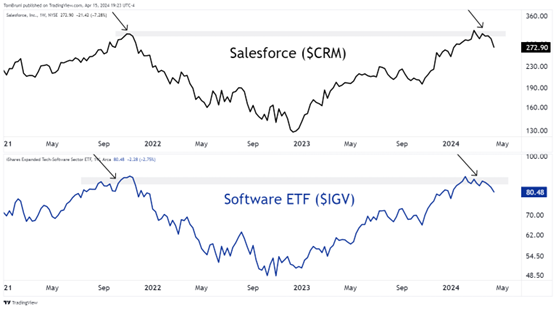

From a technical perspective, Salesforce shares failed to break above their 2021 highs, as did the popular iShares Expanded Tech-Software Sector ETF (IGV). With CRM being the second largest holding in the ETF (~9%), it’s no surprise their charts look nearly identical.

With that said, the pullback from all-time highs has gotten traders’ and investors’ attention. Given this sector helped power the market higher, its relative weakness is notable. Whether or not it’s an omen of further weakness to come remains to be seen. But it’s definitely on people’s radars now.