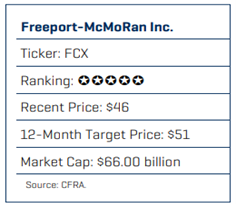

Freeport-McMoRan Inc. (FCX) carries CFRA’s highest investment recommendation of 5-STARS, or “Strong Buy.” It is one of the world’s largest copper producers and a major producer of gold and molybdenum, notes Matthew Miller, analyst at CFRA Research.

FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits, and significant mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America.

In North America, FCX operates seven copper mines: Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona, and Chino and Tyrone in New Mexico. FCX also operates two molybdenum mines in Colorado: Henderson and Climax. In South America, FCX operates two copper mines: Cerro Verde in Peru and El Abra in Chile. FCX produced 4.2 billion pounds of copper in 2023, in line with 2022.

In North America, FCX operates seven copper mines: Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona, and Chino and Tyrone in New Mexico. FCX also operates two molybdenum mines in Colorado: Henderson and Climax. In South America, FCX operates two copper mines: Cerro Verde in Peru and El Abra in Chile. FCX produced 4.2 billion pounds of copper in 2023, in line with 2022.

In 2024, we anticipate copper production to remain flat again at around 4.2 billion pounds. But gold production is poised to increase by around 17% and molybdenum should rise by around 5%. As of the end of 2023, the Indonesian smelter project was more than 90% complete and capital expenditures related to the project are poised to fall to $1 billion in 2024 (down from $1.7 billion in 2023).

We think FCX offers the best leverage to a copper bull market, as every $0.10 per pound increase in the price of copper adds around $430 million to annual EBITDA and $340 million to annual cash flow. In 2023, adjusted EBITDA was $8.3 billion and cash flow from operations was $5.3 billion.

Our Strong Buy opinion is driven by our bullish view on the copper market, FCX’s history of solid execution on growth projects, its top-tier (and geographically diverse) copper reserves, and our outlook for stable copper production at 4.1 billion to 4.3 billion pounds annually through 2026.

We expect the copper market to remain strong, given copper’s role in technological innovations, as well as the limited ability of the industry to increase supply. More than 70% of copper is consumed for applications that deliver electricity. Copper is also a critical ingredient to decarbonization.

Hybrid and electric vehicles use 2x-4x more copper than vehicles with internal combustion engines. Renewable energy technologies (wind and solar) use 4x-6x more copper than fossil fuel power generation.

Our 12-month target price of $51 assumes FCX will trade at an EV/EBITDA multiple of 7.5x our 2024 EBITDA estimate, above its three-year average forward EV/EBITDA of 6.6x. We forecast a strong copper bull market to be a positive catalyst.

Recommended Action: Buy FCX.