The price of Bitcoin recently hit $72,788, a record high. Hard asset investors who favor gold are excited about the price of the yellow metal reaching $2,175, also a record. Gold bugs should not be excited. They should probably sell their gold and buy Bitcoin, suggests Jon Markman, editor at Weiss Ratings Daily.

Digital transformation is subsuming every facet of the physical world. Bitcoin is now killing the use case for gold, and this is going to accelerate.

I want to be clear. I’m NOT making a blanket recommendation to buy Bitcoin. I believe investors should buy shares of high-quality growth companies building digital transformation infrastructure. In my opinion, equities offer superior stability. And a well-selected portfolio is the best way to play the larger digital trends.

Let me back up, though. All investments are priced by investors. That is their worth. Gold has stood the test of time because long ago someone decided that the shiny metal was valuable.

This made sense. Centuries ago, gold was difficult and costly to extract. People with the resources to mine gold accrued wealth. Gold as a store of value existed before governments and continues after many regimes have collapsed.

So, governments got smart. They created money, currencies that were initially tied to the gold holdings of a nation. Then fiat currencies came along, “money” that was backed up by the ability of the government to tax its citizens.

Unfortunately, the supply of money is unlimited. Governments can — and do — create new money supply at will, producing inherent inflation. This inflation impacts gold. After all, the hard asset is priced in US dollars, British pounds, Eurodollars, Japanese yen and other fiat currencies.

Bitcoin is the digital equivalent of gold. Some investors scoff at this notion. They are wrong to do so.

The first rule of asset pricing is that the perception of value is paramount. If the consensus of investors see value, the asset is valuable. Investors clearly view Bitcoin as a store of value and a compelling alternative to physical gold.

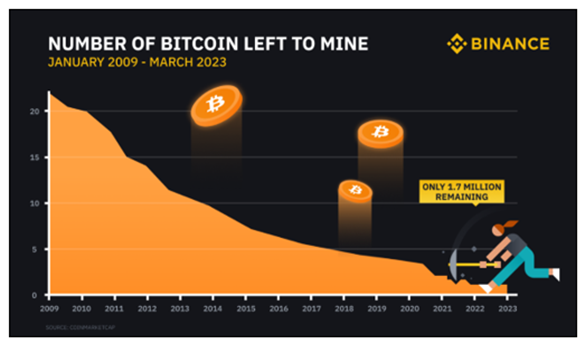

The price vectors of the two asset classes are undeniable. They move in lock step. Bitcoin is superior to gold in terms of scarcity, divisibility and portability. The supply of Bitcoin is programmatically limited to 21 million coins. Moreover, the issuance of new coins becomes increasingly more difficult the nearer to this threshold.

Source: CoinMarketCap.

The opposite is true for gold. There is no limitation. Vast quantities of gold are unmined only because it isn’t economically viable.

Goldbugs claim that gold is the ultimate currency of last resort. This is not really true. Selling the precious metal involves commissions and other hidden fees. Dividing a chunk of gold to buy a flat screen TV at Best Buy is a nonstarter.

But by design, Bitcoin is divided into tiny fractions called Satoshis. There are 100 million of these units in every Bitcoin. In theory, Bitcoin could be used to assign value to everything in the physical world, from a grain of rice to the Dallas Cowboys football club.