From the latest news and earnings reports, it looks like the Magnificent Seven leadership is changing. For starters, Apple (AAPL) and Tesla (TSLA) are beginning to falter, while the AI-related rally in Nvidia (NVDA) and Super Micro Computer (SMCI) continues to lead the overall stock market higher, notes Louis Navellier, founder and chairman of Navellier & Associates.

NVDA rose 3.6% on Monday alone, while SMCI soared 18.6%, due largely to the news that it will be added to the S&P 500 on March 18 – and many investors decided to get a head start on the index funds. It looks like Super Micro Computer snuck up on many institutional investors, since Goldman Sachs only began its coverage last Monday with a “neutral” rating, while Bank of America and Wells Fargo were also late to the party in SMCI, initiating their coverage back in mid-February.

So far, March has been characterized by wave after wave of positive analyst earnings revisions, since fourth-quarter earnings surprises were so strong. In fact, in the past month, the analyst community has revised their consensus earnings estimate by an extraordinary average of 5.3% for our average growth stock. Typically, such strong earnings revisions precede positive surprises.

In other words, this market’s current “melt up” is likely to persist, since there is plenty of fuel ($8.8 trillion in money market assets on the sidelines) that can be tapped to move back into the stock market over the next several months. Furthermore, Goldman Sachs stated that it expects corporate stock buybacks to rise by 13%, to $925 billion in 2024 and another 16% in 2025. If the volume of outstanding shares shrinks this rapidly, underlying earnings per share can rise faster.

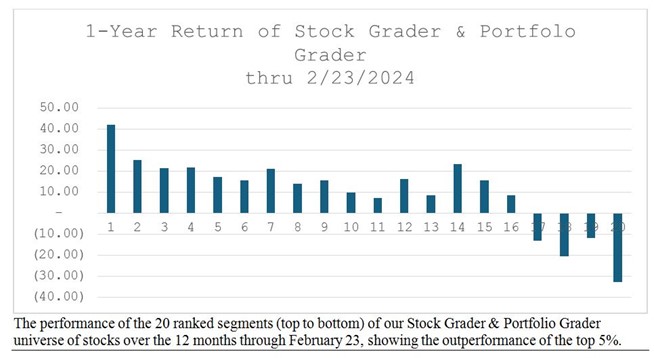

My latest back-testing of “what works now on Wall Street” (via my on-line Stock Grader and Portfolio Grader databases) revealed that the top 35% of stocks with A & B stock rankings are dramatically outperforming the overall stock market.

More importantly, the top 5% are beating the top 35% by over 2 to 1. So the stock market leadership remains concentrated in these elite, extraordinary, powerful stocks, like Nvidia, Super Micro Computer, Eli Lilly (LLY) and Novo Nordisk (NVO).

Graphs are for illustrative and discussion purposes only.

In summary, my fundamentally superior growth stocks are now acting like the market leaders. Not only do we have favorable year-over-year comparisons to boost sales and earnings, but I believe the Fed will start cutting key interest rates no later than the June FOMC meeting. Government gridlock is allowing the private sector to prosper and since this year is a presidential election year, change is coming.

Americans can sense that investor optimism is rising, so that $8.8 trillion of cash on the sidelines I expect will fuel a rally in growth stocks this year, possibly even better than in 1999!

Disclosures: Navellier & Associates owns Nvidia Corp (NVDA), Super Micro Computer, Inc. (SMCI), Novo-Nordisk A/S Sponsored ADR Class B (NVO), Eli Lilly and Company (LLY), and some accounts own Tesla (TSLA), and Apple Computer (AAPL), in managed accounts. Louis Navellier and his family own Nvidia Corp (NVDA), Super Micro Computer, Inc. (SMCI), Novo-Nordisk A/S Sponsored ADR Class B (NVO), and Eli Lilly and Company (LLY), via a Navellier managed account, and Nvidia Corp (NVDA) and Apple Computer (AAPL) in a personal account. He does not own Tesla (TSLA) personally.