Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns, advises Lance Roberts, editor of Bull Bear Report.

Since 1833, stocks have gained an average of 10.03% in the year of a presidential election. By contrast, the first and second years following a presidential election see average gains of 6.15% and 6.94% for the S&P 500, respectively. There are notable exceptions to positive election-year returns, such as in 2008, when the S&P 500 sank nearly 37%. (Returns are based on price only and exclude dividends.) However, overall, the win rate of presidential election years is a very high 76.6%

Since President Roosevelt’s victory in 1944, there have only been two losses during presidential election years: 2000 and 2008. Those two years corresponded with the Dot.com Crash and the Great Financial Crisis. On average, the second-best performance years for the S&P 500 are in presidential election years.

For investors, with a “win ratio” of 76%, the odds are high that markets will most likely finish the 2024 presidential election year higher. However, given the current economic underpinnings, I would caution against completely dismissing the not-so-insignificant 24% chance that a more meaningful correction could reassert itself.

Given the recent 15-year duration of the ongoing bull market, the more extreme deviations from long-term means, and ongoing valuation issues, a “Vegas handicapper” might increase those odds a bit.

As for the election results, will potential policy shifts matter? The short answer is “Yes.” However, not in the short term.

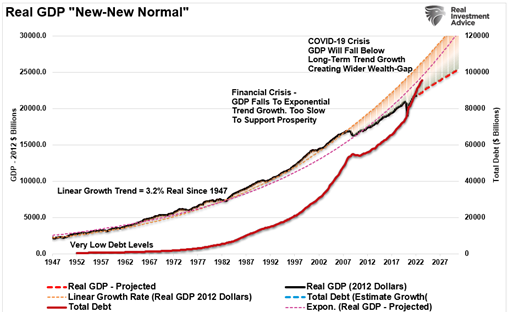

Presidential platforms are primarily “advertising” to get your vote. As such, a politician will promise many things that, in hindsight, rarely get accomplished. Therefore, while there is much debate about whose policies will be better, it doesn’t matter much as both parties have an appetite for “providing bread and games to the masses” through continuing increases in debt.

Lastly, while policies matter over a longer-term period, as changes to spending and regulation impact economic outcomes, market performance during SECULAR market periods varies greatly. During secular (long-term) bull markets, as we have had since 2009, presidential election years tend to average almost 14% annually. That is opposed to secular bear markets, which tend to decline by 7% on average.

So, how do you position your portfolio for the election? Over the last few weeks, we have repeatedly discussed reducing risk, hedging, and rebalancing portfolios. Part of this was undoubtedly due to the exaggerated rise from the November lows and the potential for an unexpected election outcome.

Holding a little extra cash, increasing positioning in Treasury bonds, and adding some value to your portfolio will help reduce the risk of a sharp decline in the months ahead. Once the market signals an all clear, you can take your foot off the brake and speed to your destination.