The spot price of uranium dropped 10% over the last two weeks – and some investors freaked out. I am not freaking out. In fact, I’m using this pullback to buy more uranium exposure. Let me explain why, counsels Gwen Preston, editor of Resource Maven.

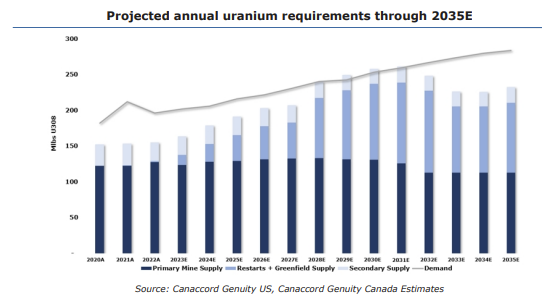

Uranium doubled in price over the last year because there is not nearly enough supply to meet demand. The market is also being split into two halves, east and west. That is making the supply gap worse, especially for the west, where production is lower and demand keeps ramping higher.

Canaccord just issued a report called The State of the (Nuclear) Union in the United States, which summarizes all the legislative and financial supports for nuclear underway across the country. Federal legislation has gotten fair coverage already – major support for nuclear fuel and power in the Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act of 2022, for instance. But there has been a lot of pro-nuclear movement on the state level as well.

Below I’ve listed some – not all, just some – of those:

- Virginia: New legislation promoting nuclear power, de-risking project permitting, and establishing a Virginia Nuclear Innovation Hub

- Texas: Governor Abbott just mandated the Public Utility Commission “to establish a working group to study and plan for the use of advanced nuclear reactors in Texas…I charge the working group to submit a plan and recommendations to my office by December 1, 2024, outlining how Texas will become the national leader in using advanced nuclear energy.”

- Tennessee: New Nuclear Advisory Council to address regulatory, workforce, and education barriers limiting the expansion of nuclear energy in the state

- Many states: Have recently passed legislation labeling nuclear power as “clean energy,” which opens doors to big pools of funding and reduces barriers

- West Virginia, Connecticut, Montana, Kentucky, Wisconsin: All removed restrictions on building new nuclear facilities in recent years

The US is becoming decidedly pro nuclear. Public sentiment has shifted dramatically on this in just the last few years. It all means that uranium demand is ramping. And there is just no quick answer to on the supply side. It will take years to get enough new uranium production online to meet demand. In the meantime, utilities will have to compete for pounds, which is the recipe for higher prices.

The price was recently trading sideways at $95 for a few days. Uranium stocks slid more than the spot price because newer uranium investors, including some who piled in during the latest surge, often don’t understand short-term pressures. They just saw a notable price correction, freaked out that the bull run was over, and sold.

But this is a buying opportunity. The uranium bull run is far from over.