For a lot of people on Wall Street, the past week has been a holding period. While the news has generally been constructive, investors aren’t quite ready to commit to a “soft landing” until they dodge a few more walls of worry. Meanwhile, I want to talk about one of my “perennial yield stocks,” FS KKR Capital Corp. (FSK), writes Hilary Kramer, editor at IPO Edge.

Early-stage investing revolves around looking at least a year or two out past the present. We need a fresh supply of good stocks to replace the ones that have been on the market too long to really justify holding a spot in an IPO-oriented portfolio.

Recent deals have been resilient on the whole. They aren’t all champions (plenty of relapses as each of the investment banks figures out how to operate in the current market environment), but this is probably the first time since 2021 that they aren’t overwhelmingly losers.

And there’s a reason for that. Companies that survived the shocks of the last few years are basically built to succeed in the face of elevated economic stress. The Fed couldn’t hold them back. They held up under pressure. And their business models came up smiling.

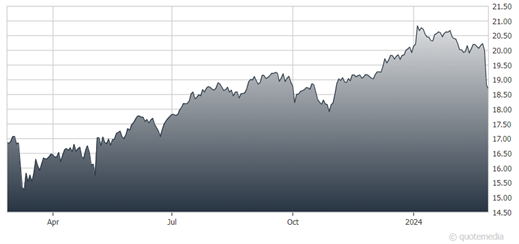

FS KKR Capital Corp. (FSK)

Just look at the earnings reports we’ve been getting. Arm Holdings Plc (ARM) was transformational. CAVA Group (CAVA) is doing exactly what it set out to do: Disrupt the fast-food landscape just like Chipotle Mexican Grill (CMG) did a generation ago. Even long-suffering Maplebear (CART) is now a profitable position for us.

As for FSK, the company makes its money lending to true small businesses on the economic front lines...companies too small to ever go public, but profitable enough to make their debt payments.

They’re doing fine. FSK took in only about $900 million in net profit after paying its own overhead and financing costs. That’s $0.71 per share, enough to cover the regular dividend with a tiny cushion left over.

Plus, the Fed is probably going to relax later this year. Lower overnight rates give companies like FSK a chance to widen their profit margins because they can borrow at the short end of the yield curve and distribute that money as higher-yielding loans on the long end.

Profit should reinflate in the coming year. But even if it doesn’t, this feels like a bottom, a worst-case scenario. If it’s enough to give investors who buy FSK here below $19 a reasonable chance to recoup at least $2.90 per share every year, that’s not so bad at all.

That’s a 15% yield. Management is extremely sanguine about hitting that payout target. We’re happy to grab that yield for the foreseeable future.

Recommended Action: Buy FSK.