The best stock within our Portfolio? Medpace Holdings (MEDP). The stock was recently up more than 60% since we first bought it in October and by more than 25% over a recent five-day period. But I still believe Medpace is a great example of a wonderful company at a fair price, writes CQ, editor of Compounding Quality.

Medpace is a Clinical Research Organization that executes (pre)clinical tests for biotechnology companies. It’s important to highlight that Medpace itself is not a biotechnology company. They help biotechnology companies execute their clinical tests, providing them with robust cash flows.

Medpace just published great results for the full year 2023. This is something we love to see. Here are some key takeaways:

- Revenue: $1,885.8 million (+29.2%)

- EBITDA: $362.5 million (+17.7%)

- Net new business awards: $2,356.7 million

- Book-to-bill ratio: 1.25x

- GAAP net income: $282.8 million (+15.2%)

- Net Income margin: 15% (versus 16.8% the year before)

As for 2024 guidance, revenue should come in at $2.15-$2.2 billion (growth of +14% to +16.7%). The company is also expecting EBITDA of $400 million - $430 million, GAAP net income of $326 million - $348 million, and diluted GAAP EPS of $10.18 - $10.87.

Meanwhile, August Troendle expects the company’s growth to accelerate again after 2024. He sees a growth rate of 15% as a “bottom.”

In 2023, Medpace repurchased 781,068 shares for $144 million. While it had no share repurchases in the fourth quarter, Medpace had $308.8 million remaining under its authorized share repurchase program at the end of last year.

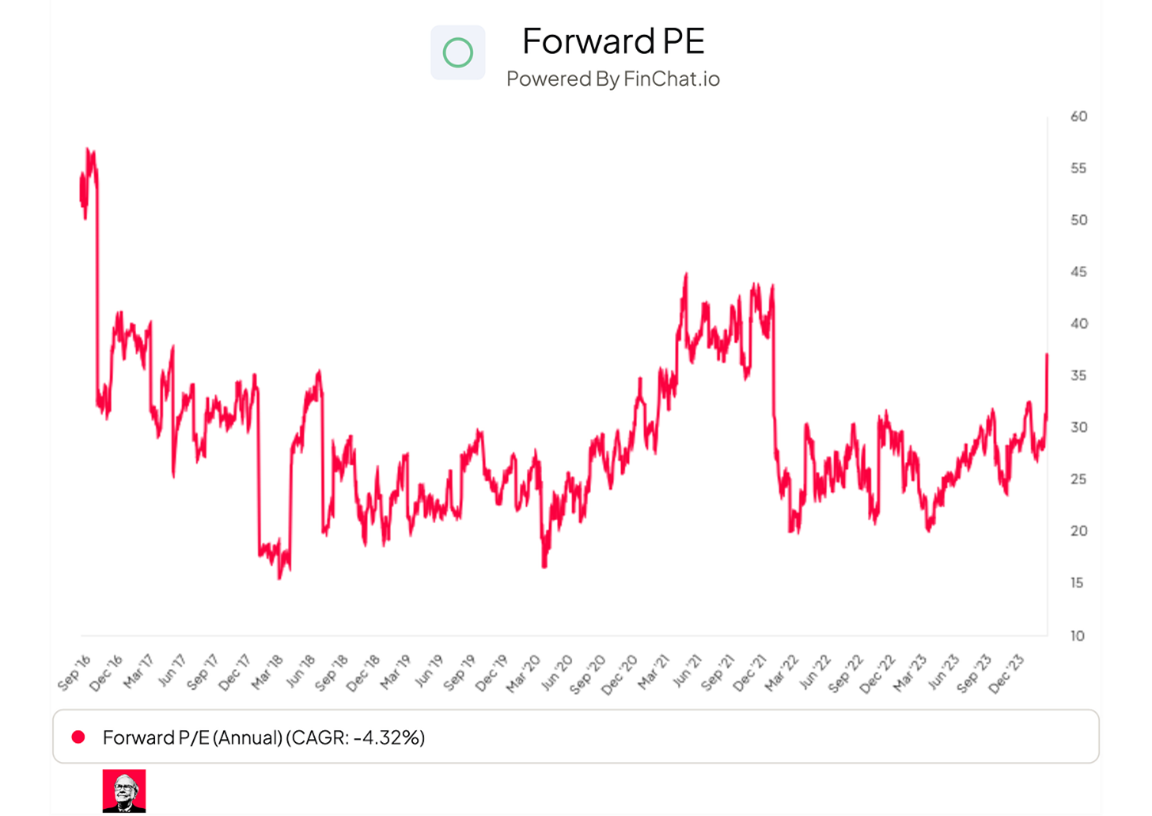

Today, Medpace trades at a forward PE of 37.2x. This is definitely not cheap. Over the past five years, the average forward PE of Medpace was equal to 30.5x.

A lot of future growth has already been priced in. As a result, we are not in a rush to add to our position. However, we also have no intention to sell as we let our winners run.