Dividend-paying uranium investments may be worth purchasing because they have dipped in price lately, offering what could become a fresh chance to profit. Global X Uranium ETF (URA) is one that has amassed nearly $900 million of investment inflows in the past 24 months, highlights Paul Dykewicz, editor of StockInvestor.com.

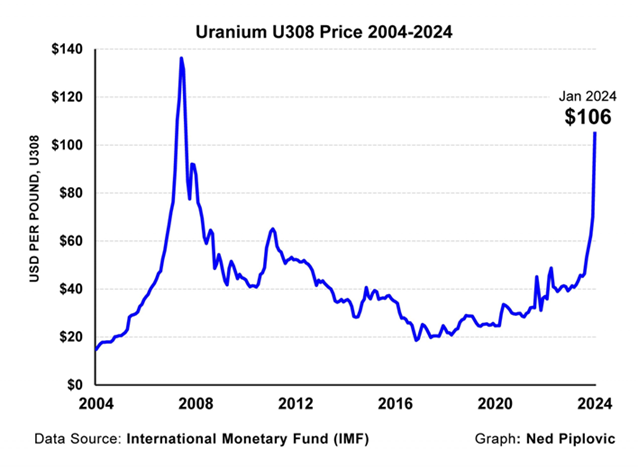

Uranium investments rose along with the commodity's physical price. It recently reached $106 per pound, the highest level since June 2007 when the chemical element used in fueling nuclear energy hit its all-time peak of $136 per pound. Uranium prices spiked briefly back then when enthusiasm for nuclear energy erupted and the world's biggest mine for the metal flooded, shrinking supply.

The price per pound has jumped 147% since Russia's invasion of Ukraine in February 2022. In 2023, the price of uranium oxide concentrate, U308, also known as yellowcake, soared 90% as demand spiked amid limited supply.

Aside from uranium supply chain challenges, other reasons for growing interest in the commodity include nuclear expansion plans around the world and geopolitical tensions. Those factors combine to keep upward pressure on uranium prices.

Even though certain uranium mining operations have restarted and several resumed production, supply still needs time to ramp up. BofA Global Research forecasts that current uranium supply-and-demand imbalances will persist, with deficits projected through the rest of 2024.

URA is one way to play the trend. The fund recently featured a 5.7% dividend yield and net assets of $2.4 billion.

Recommended Action: Buy URA.