The Dividend Kings list consists of companies that have raised their dividends for at least 50 years in a row. Because of their unparalleled streak of annual dividend increases, it is common to view the Dividend Kings as among the best dividend growth stocks in the stock market. Consolidated Edison (ED) recently joined the exclusive list, outlines Bob Ciura, contributing editor at Sure Dividend.

Con Ed is a large-cap utility stock. The company generates approximately $14 billion in annual revenue and has a market capitalization of approximately $31 billion. The company serves more than 3 million electric customers, and another 1 million gas customers, in New York. It operates electric, gas, and steam transmission businesses.

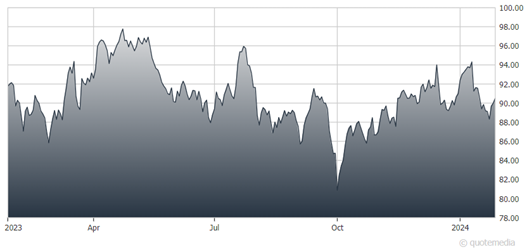

Consolidated Edison (ED)

On Nov. 3, the company reported third-quarter results for the period ending June 30. For the quarter, revenue grew 7% to $3.87 billion, which was $36 million more than expected. Adjusted earnings of $561 million, or $1.62 per share, compared to adjusted earnings of $579 million, or $1.63 per share, in the previous year. Adjusted earnings-per-share were $0.03 above estimates.

As with prior quarters, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets. Average rate base balances are expected to grow by 6% annually through 2025. Consolidated Edison expects capital investments of nearly $15 billion for the 2023 to 2025 period.

The company provided updated guidance for 2023 as well. It now expects adjusted earnings per share in a range of $5 to $5.10 for 2023, up from $4.85 to $5 and $4.75 to $4.95, previously. At the new midpoint, this would be a 10.5% increase from the prior year.

Con Ed can be a valuable holding for income investors, such as retirees, due to its recent 3.7% dividend yield. The stock offers secure dividend income, and is also a Dividend King, meaning it should raise its dividend each year.