US stocks rallied strongly on Wednesday as the Fed held its key interest rate steady for the third consecutive meeting and paved the way for several rate cuts in 2024. For domestic stock funds there is one new Buy this week: Vanguard US Growth Fund (VWUSX), writes Brian Kelly, editor of Money Letter.

The Fed’s median interest rate projection (the “Dot Plot”) indicated one less cut next year than futures had predicted, but the three projected cuts were received well by investors. The Dow Jones Industrials gained 512 points and the 10-year Treasury yield dropped to its lowest level since August at 4.02%.

Fed Chair Jerome Powell did not take future rate hikes off the table completely at his presser. But unless the incoming data surprises the Open Market Committee, they clearly believe that this interest rate hiking cycle is complete.

With core inflation still double the target, and market yields effectively doing a lot of the Fed’s work, we don’t believe the Fed will be as aggressive with rate cuts in 2024 as market participants expect. This could lead to volatility and a pullback in equity prices, likely in early 2024.

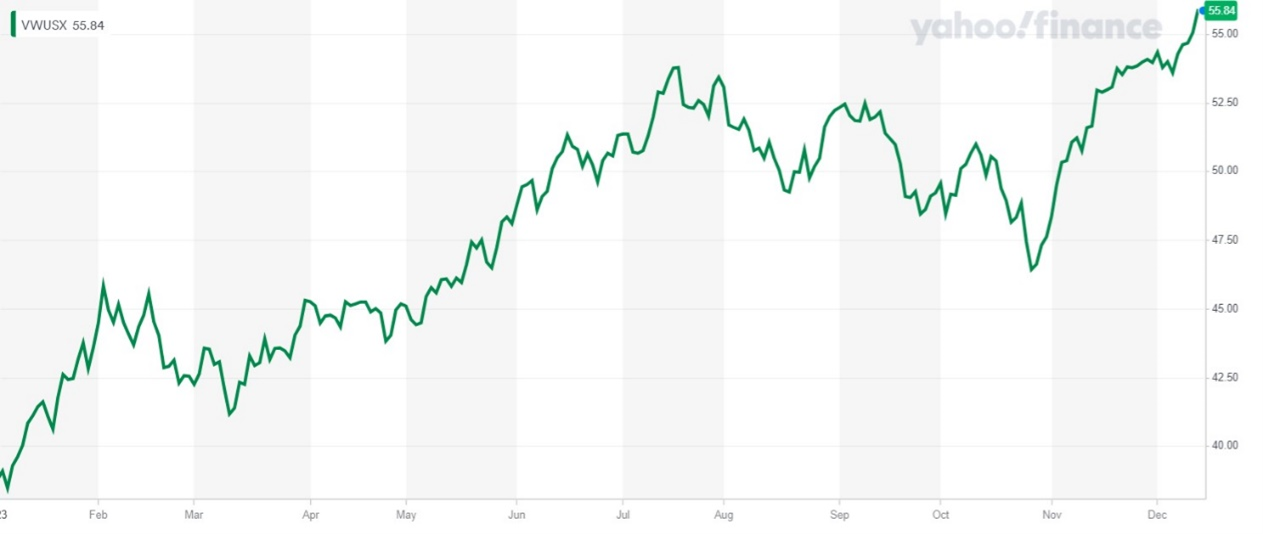

Vanguard US Growth Fund (VWUSX)

But for now, the Santa Claus rally is well underway. Maintain your asset allocations. Also, buy VWUSX. The fund invests mainly in large-capitalization stocks of US companies considered to have above-average earnings growth potential and reasonable stock prices in comparison with expected earnings.

Recommended Action: Buy VWUSX.