Every now and then we run across a stock like life insurer Lincoln National (LNC), which offers a high yield and strong payout growth. LNC recently yielded 7.4% and has hiked its payout 4,400% since the trough of the 2008/2009 financial crisis, writes Brett Owens, editor of Contrarian Income Report.

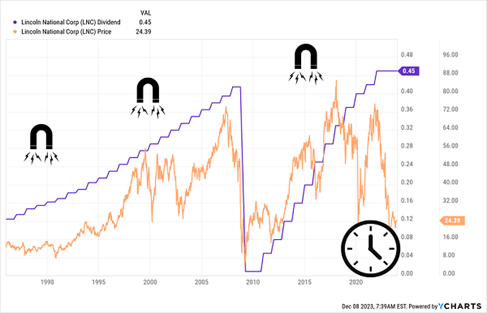

The firm is a 118-year-old insurer that’s a case study in a rising payout pulling a stock price higher – a phenomenon I call the “Dividend Magnet.” Consider the chart below: You can clearly see the pattern of LNC’s share price (in orange) tracking its dividend growth (in purple) since payouts started in the 1980s.

LNC’s Dividend Magnet Is Due

To be sure, management brought in a steep cut during the ’08/’09 crisis. But we can forgive LNC. It was far from alone, especially among financial stocks, back then.

Here’s the key thing: Every time LNC’s price drops too far behind the payout, it gets pulled back up. And right now, its Dividend Magnet is overdue to haul its stock higher again.

LNC has more going for it, too. Back in April when I first recommended it, LNC was about as cheap a stock as we’d ever seen, trading at a P/E ratio below three. Three! And it was paying a rich 8.3% yield back then, too.

These days it’s still well within the bargain category, trading at 4.5-times its 12-month projected EPS. Why so cheap? LNC ran into some liquidity problems in late 2022, likely because it bought a bunch of Treasuries just before they plunged, as was the case with Silicon Valley Bank.

Scary comparison, I know. But that was the reason for the sale on the stock: it was priced into the company’s P/E and its book value. Back in April, LNC traded for 64% of the value of its physical assets. In other words, we had the opportunity to get its insurance, annuity, group benefits, and retirement planning businesses – not to mention its 118-year-old brand – for free.

Moreover, we correctly believed the issues were transitory. Lincoln National raised money by issuing preferred shares, and let me tell ya, no one buys preferred shares of a company in trouble. What’s more, its Treasury bond positions are bouncing back as interest rates ease.

Meantime, LNC’s dividend was, and remains, sustainable. The company pays 41% of its last 12 months of free cash flow (FCF) as dividends, below the 50% “safety line” I like to see in regular stocks.

As the company finishes using excess FCF to shore up its balance sheet and resumes payout hikes, it’s likely to move solidly into the “dividend growth” camp. Further hikes would attract more investors, driving the share price up and the dividend yield down. That’s a good thing – and another reason to give LNC a look now.

Recommended Action: Buy LNC.