Traditional emerging market (EM) ETFs have a 25%-30% exposure to China, which underperformed in 2023. In 2024, investors may “unbundle” their EM exposure by using EM ex-China ETFs or active ETFs that dynamically calibrate their China exposure. One name to consider is the iShares MSCI Emerging Markets ex China ETF (EMXC), notes Aniket Ullal, VP, ETF Data & Analytics at CFRA Research.

The ETF industry in the US had a strong 2023, setting a calendar record for new launches. Although inflows were lower than anticipated due to investors rotating into money market funds, they will likely be close to a robust $500 billion by year-end. Given this context, what ETF trends will emerge next year?

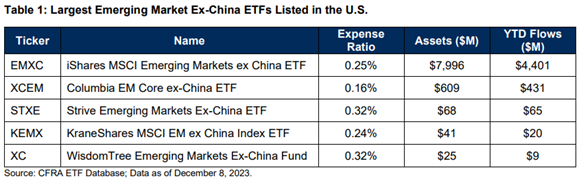

One trend is the “Unbundling” of emerging markets exposure. For many years, ETF investors have accessed emerging markets via broad ETFs like the iShares Core MSCI Emerging Markets ETF (IEMG). As of Dec. 8, the four largest emerging market ETFs accounted for 58% of all assets in equity-based EM exposure in the US.

All four provide diversified exposure across countries, highlighting how broad ETFs have historically been the vehicle of choice for US investors accessing emerging markets. Looking ahead to 2024, however, we may see this changing, with investors opting to take a more nuanced approach by using more targeted regional and country-specific funds.

A driver of this change is the significant exposure to China in traditional emerging market ETFs. China exposure in these ETFs ranges from 25%-30%. This large China weighting reflects its status as the largest and most important emerging market. Additionally, China’s weight in many emerging market ETFs increased after MSCI (the leading index provider for ex-US equity exposure) began phasing in China “A” shares into their indices starting in 2018.

However, having such a high exposure to China in their primary emerging market holdings was challenging for ETF investors in 2023. China significantly underperformed ex-China emerging markets this year. The SPDR S&P China ETF (GXC) was down 12% year to date through Dec. 11, while the EMXC was up 12% during the same period.

China’s underperformance was driven by a slower-than-anticipated post-Covid reopening, as well as weakness in the country’s property sector. The country could also be impacted by longer-term issues, such as global firms diversifying their supply chains to other Asian countries, and by geo-political tensions with the US. If China continues to underperform in 2024, investors may decide to “unbundle” their EM exposure.

Recommended Action: Consider EMXC for ex-China global market exposure.