The stock market has been surging, thanks to the ongoing decline in interest rates. Currently, all of the stock indexes are bullish above their moving averages. This tells us the major trends are up and as long as they are, stocks are going to rise further. Stick with the Invesco QQQ Trust (QQQ), write Mary Anne and Pamela Aden, editors of The Aden Forecast.

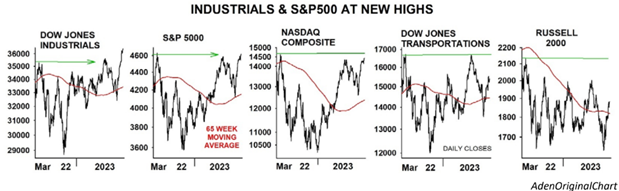

The market seems convinced that rates are going lower, and this led to one of the best November gains in the S&P 500 over the past century. But it wasn’t just the S&P 500. As you can see in this chart, the Dow Jones Industrials also joined the S&P 500 by breaking above its 2022 high, which was a strong resistance level.

This is bullish action, signaling that stocks are headed higher in the months ahead. On the other hand, the Dow Jones Transportations and the Russell 2000 are lagging, but they’ll likely soon catch up and follow the leaders into a stronger rise.

This is being reinforced by Richard Russell’s famous Primary Trend Index (PTI). Note, it’s hitting new record highs, above its moving average. This too is a strong signal that the market’s primary trend is up.

More impressive is the fact that the PTI’s leading indicator remains quite low. This means it has plenty of room to rise further before it reaches the major high area. So again, this tells us the PTI is likely headed higher in the upcoming months, which is another good sign for stocks.

That’s why we continue to advise buying and holding your stock ETFs for the time being. These have done very well, and they’re all set to move higher. But they’re currently somewhat overbought, having risen too far, too fast, so it would not be unusual to see an upcoming pause or downward correction.

Recommended Action: Buy QQQ.