Just a few things that I saw so far with holiday retail sales. Mastercard SpendingPulse said Black Friday was up 2.5% YOY in nominal terms, and that covers both store and online. It was mostly driven by jewelry, apparel, sporting events, and restaurants (likely including gift cards). Meanwhile, gold continues to trade very well in the face of high real rates, writes Peter Boockvar, editor of The Boock Report.

Foot traffic according to RetailNext was higher by 2.1% YOY, led by health and beauty. Adobe Analytics said they saw sales up 7.5% YOY on Black Friday, just looking at online. The National Retail Federation is forecasting overall November and December consumer spending, also in nominal terms, to be up 3-4% YOY, including both stores and online.

Taking advantage of deals was the goal of many consumers and there were certainly discounts and promotions to be had as there always is this time of the year. A key reason for the deals is that we know hearing from countless retailers that consumers are more circumspect with their spend right now. Also, retailers order their holiday inventory many months ago and none want to get stuck with excess inventories.

So what is good on the inflation front is also in response to a more 'choiceful' consumer. That’s a word I heard some retailers use as they are trying to keep inventories lean after the excessive inventories they built up after last year's holidays.

The key question for inflation in 2024 and the years beyond is the fine line that the Fed is trying to dance around here. It is doing its best to temper demand for things. But at the same time, it is crushing the supply capacity of the US economy via higher interest rates, which itself will lead to another rise in inflation in the coming years.

For example, countless trucking companies are going out of business, with Yellow being the highest profile. That will eventually lead to a firming in transportation prices. There is very little brand-new multifamily construction going on as a large existing amount gets finished. That will eventually lead to a resumption of rental price gains after 2024-2025.

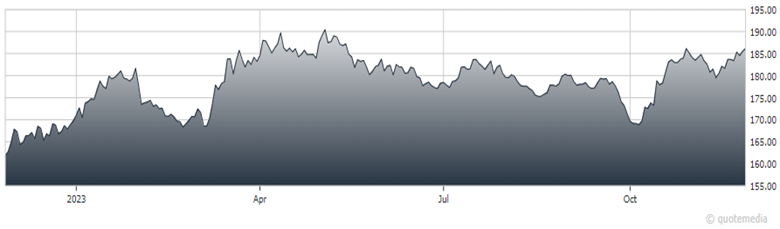

SPDR Gold Shares ETF (GLD)

As for gold, it is rallying to the highest since July and is a stone’s throw from a record high. We remain, again, bullish and long of gold and silver.

Really the only bull case for the dollar over the past few years was a more aggressive Fed than other central banks, nothing more. That advantage is now reversing and its flaws are now being revealed (accelerating US debts and deficits and parts of the world that are increasing their once-dollar-based transactions with other currencies).