More than 75% of the stocks in the S&P 500 pay a dividend, and the dividend for many of them exceeds the yield on US 10-year Treasury bonds (currently around 4.5%). However, screening for the highest-paying dividend stocks in the S&P 500 reveals some even more impressive yields. One generous payer that I looked at recently is Healthpeak Properties (PEAK), writes Clif Droke, chief analyst of Cabot SX Gold & Metals Advisor.

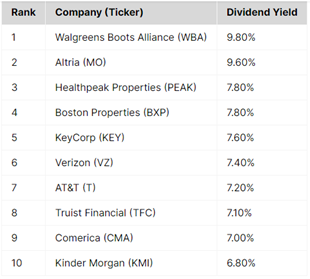

Several high-dividend stocks in the S&P 500 currently yield over 5%. And the top 10 highest-paying dividend stocks all yield above 6%.

Higher yields come with higher risks, though. Many of these stocks’ yields are so high because they’re struggling, and some may end up slashing their dividends.

Higher yields come with higher risks, though. Many of these stocks’ yields are so high because they’re struggling, and some may end up slashing their dividends.

From highest yield (9.77%) to lowest yield (6.83%), this table shows the 10 highest-paying dividend stocks in the S&P 500 today.

PEAK is one that recently yielded 7.8%. It is a healthcare-focused REIT (Real Estate Investment Trust) that is new to this list but has been an S&P 500 component since 2008.

The company owns and operates over $20 billion of lab and outpatient facilities (healthcare discovery and delivery in the company’s parlance) with an emphasis on Seattle, Boston, and San Francisco (for labs) and outpatient facilities tethered to either the #1 or #2 hospitals in their local markets. The company also invests in continuing care retirement communities, which typically provide a range of care to senior residents.

Its inclusion on the list largely owes to underperformance, with shares down 37% in the last year and 45% in the last five. The company has been paying $1.20 per share annual dividends since 2021. That’s down from a peak of $2.30 in 2016.

Recommended Action: Buy PEAK.