Some stock stories stick with you more than others. For me, Newell Brands (NWL) is among them. Maybe best known for its 1999 merger with Rubbermaid, later dubbed “the merger from hell,” Newell went through so many incarnations and acquisitions over the years that it can be hard to keep them straight. It was like a corporate shell game, and that’s never a good sign, recounts Herb Greenberg, editor of Herb Greenberg On the Street.

No wonder Newell landed on the radar of the short research firm I was with in 2017, prompting us to publish a report in September of that year headlined…Is Newell About to Get Run Through the Osterizer?

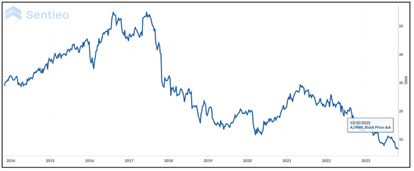

The stock had already taken a tumble on an earnings disappointment – not its first – but as we wrote, “red flags are flying everywhere we look.” The pushback we received at the time, from a few subscribers, was that “the valuation has already compressed.” Indeed it had, reflected by its stock, which had tumbled about 20% in the months before we published.

But our work suggested something worse was going on.

That’s the trouble with the “compressed” argument, and why it’s a steady theme here. As Newell shows so clearly, just because a valuation has compressed doesn’t mean it can’t compress more. And, boy, did Newell’s valuation compress...and compress...and compress.

It was 41 when we launched coverage, plunging another 28% on bad earnings news less than two months later. Subsequently, nothing helped. Not new management. Not activists.

The business wasn’t just broken, its performance was an illusion...the result of management resorting to accounting sleight of hand in an effort to distract investors from seeing just how much management had boxed itself into a corner of overpromising on what it could realistically deliver. In the end, it was outright (not to mention good, old fashioned) earnings manipulation.

I hadn’t thought about this until a few weeks ago when Bill Whiteside and Jeff Middleswart at Peek Behind the Numbers here on Substack wrote a report headlined, “Newell Brands and the SEC – At Last They Meet.”

Long story short, the SEC sued Newell and ex-CEO Michael Polk for “misleading investors” in 2016 and 2017...

In other words, they lowered the boom six years after the fact, and nearly four years after the company first acknowledged receiving a subpoena related to the issue. As is usually the case, both sides settled. This would’ve been an easy one to miss, because it happened so long ago. And Newell at this point is not what I’d call a made-for-TV name.

There’s also the fact that investors generally roll their eyes at SEC investigations, since they’re often so long after the fact, as was the case here. But they’re important, if no other reason than serving as a reminder how far even today management will go to make things look better than they really are.

When we first wrote about it, Newell’s market cap topped $20 billion. Today it’s $2.7 billion.

Subscribe to Herb Greenberg’s commentary on Substack here...