Like it protected castles from plunderers in olden times, a moat protects a company from competitors in the business world. Companies with wide moats can offer investors more peace of mind as they are generally more stable blue-chip stocks – and one of them we like is BlackRock (BLK), writes Bob Ciura, contributing editor at Sure Dividend.

A company’s moat can be thought of as its competitive advantages, namely its advantages over competitors. This moat can be narrow or it can be wide. A narrow moat is a smaller competitive advantage over peers, while a wide moat can mean the company has a significant advantage over peers, which likely protects its results through multiple economic cycles.

Narrow and wide moats have minimum life expectancy of 10+ and 20+ years, respectively, which they are anticipated to benefit the company.

We often see that companies with wide moats are better able to continue growing earnings and as a result, grow their dividends for many years. These companies also usually have strong margins in relation to their peers, as their moats protect their profits and market share.

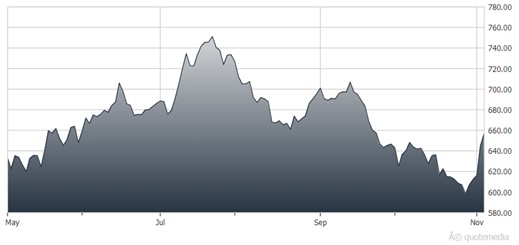

BlackRock (BLK)

BlackRock is a large investment and asset management firm. It was founded in 1988 and today has over $9 trillion of assets under management (“AUM”). BlackRock provides investment management, risk management, and advisory services for institutional and retail clients worldwide. Its products include single and multi-asset class portfolios, equities, fixed income, alternative investments, and money market instruments.

Around 80% of BlackRock’s revenue is derived from investment advisory, administration fees, and securities lending, while the remainder is generated from performance fees, distribution fees, and technology services revenue.

On Oct. 10, BlackRock announced its Q3 2023 results. For the quarter, revenue rose 5% to $4,522 million, primarily due to organic growth, the impact of market movements over the past 12 months on average AUM, and higher technology services revenue.

Operating income climbed 7% to $1,637 million, operating margin expanded to 36.2% (versus 35.4% in Q3 2022), net income climbed 14% to $1,604 million, and diluted earnings-per-share (“EPS”) rose 15% to $10.66. Adjusted EPS jumped 14% to $10.91. Earnings growth reflected a lower effective tax rate, partly offset by lower non-operating income in the quarter.

Recommended Action: Buy BLK...