As interest rates increased the last few years, we gradually adopted what I call the barbell portfolio. It is going to be a good strategy for some time. Meanwhile, the Israel-Hamas war and other international conflicts should keep a floor under gold, so I recommend holding the iShares Gold Trust (IAU), explains Bob Carlson, editor of Retirement Watch.

Many years ago, an investment banker friend told me most of the top bankers put the bulk of their money into safe investments that pay interest and have principal protection. That gives them financial security.

The rest of their money is selectively invested in growth opportunities. The barbell portfolio wasn’t viable for a number of years because the Federal Reserve kept interest rates on safe investments near zero. But with the big jump in rates since the end of 2021, safe investments now pay decent yields. The barbell portfolio is a good strategy if dividend yields are near or above current levels.

High levels of risk in many investments make it wise to keep a substantial part of the portfolio in safe investments and be selective about where we take risk. We continue to benefit from the move away from bonds and other traditional fixed-income investments that we began in 2017. We avoided the historic losses Treasury bonds experienced after the Fed returned to fighting inflation.

Since August 2021, long-term Treasury bonds are down about 46%, according to Bloomberg. This move surprised most investors. Futures markets showed that over the last few years, investors expected the Fed to begin reducing interest rates long before now. Yet, market rates made a new move higher beginning in the spring as investors realized inflation wasn’t collapsing.

Over the last couple of years, we shifted to a combination of multi-year guaranteed annuities (MYGAs), certificates of deposit (CDs), and money market funds (MMFs). Yields on the MMFs steadily increased this year, with many now offering 5% or more. The MMFs continue to be the best current opportunity.

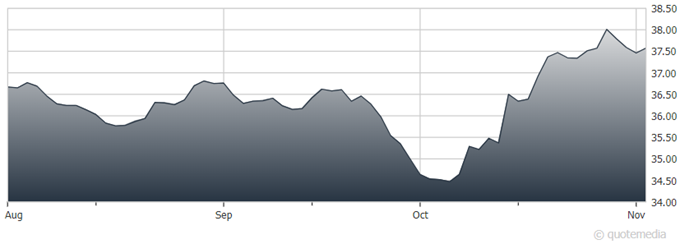

iShares Gold Trust (IAU)

There will come a time to move some of our money into long-term bonds or other investments that benefit from declining interest rates. I don’t believe this is the time, because inflation still is solidly above the Fed’s target, the labor market is strong, and many areas of the economy are doing well.

A consideration of only economic factors would make me recommend selling gold, which we own through IAU. But for now, gold is good insurance against geopolitical problems. IAU was recently up 0.9% in the last four weeks, 5.5% so far in 2023, and 15.6% over 12 months. It is down 1.72% over three months.

Recommended Action: Buy IAU.