Small cap stocks trade at historically cheap valuations due to historically high interest rates. But steady to lower rates and a “no recession” economic scenario could catalyze meaningful upside. Plus, the nation’s largest telecommunications infrastructure contractor – Dycom Industries (DY) -- leverages AI and 5G at low valuation, notes Adam Johnson, editor of Bullseye Brief.

Finding opportunities in the market depends on doing three things correctly: Identifying macro-economic themes that provide powerful tailwinds over time...selecting specific stocks which best leverage these themes, based on fundamentals and data...and quantifying potential upside and downside to optimize risk/reward.

Applying this framework to the present, demand for bandwidth to support new AI applications creates a powerful tailwind for telecom infrastructure providers, and one company in particular stands to benefit. It’s also trading at its cheapest valuation in years, another important theme currently given the impact of high interest rates. As inflation recedes and the economy normalizes, I believe valuations in general will rise, especially for companies levered to growth themes as powerful as AI and 5G.

Dycom operates as one of the country’s largest specialty contract services providers to the telecommunications infrastructure and utility industries. Active in 49 of 50 states, Dycom designs, installs, and maintains arial and buried fiber optic cable systems, copper and coaxial communications networks, cellular towers and base stations, and large-scale electricity generating plants.

Telecom services spending will rise 4% this year according to Statista, compared to a 2% decrease last year. The shift could mark the beginning of an extended capex cycle as providers look to push more data through the pipe, a direct result of 5G service, cloud computing and artificial intelligence. Even basic AI programs like Chat-GPT require significantly higher capacity, up to three times the bandwidth by some estimates. This is very good for Dycom.

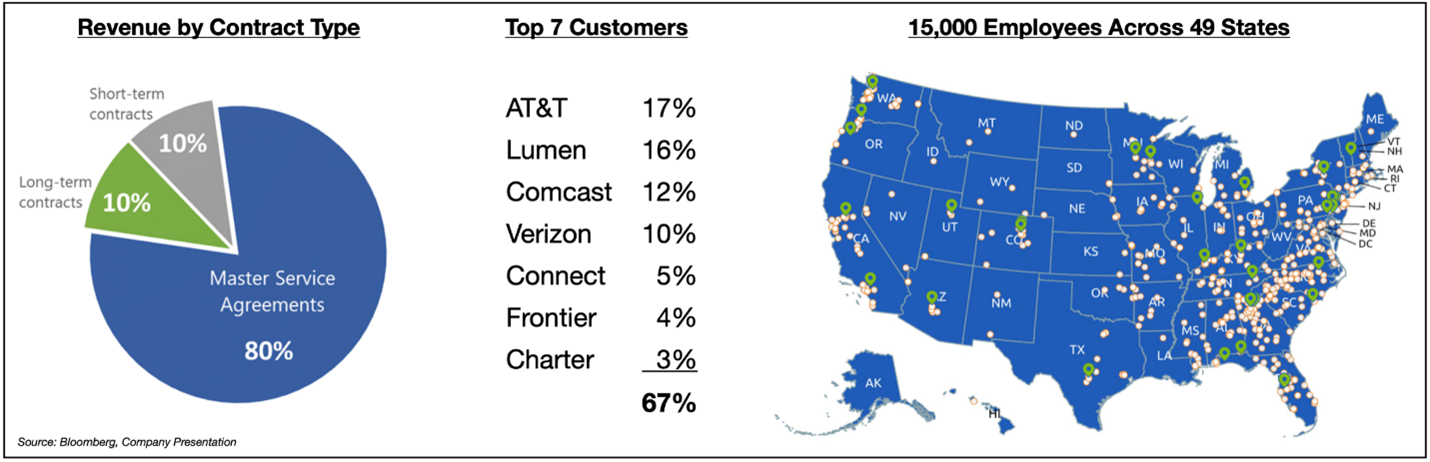

Dycom positions itself at the heart of a telecom provider’s network, as evidenced by the structure of their contracts. Master Service Agreements account for 80% of Dycom’s revenue, embedding the company with marque customers like AT&T and Comcast.

As a result, Dycom does it all, from laying pipe and monitoring flow to maintaining performance and upgrading over time. Dycom’s team of 15,000 employees across 40 subsidiaries in 49 states become an extension of the operator.

Critically, the company’s top seven customers have worked with Dycom for many years and account for two-thirds of firm-wide revenue, providing cashflow consistency and earnings visibility.

Finally, Dycom is historically cheap, trading at 14 times earnings vs. a 10-year average of 20 times. The valuation discount is representative of small caps in general and reflects pressure implied by higher interest rates. As inflation abates and the economy normalizes, I expect valuations will re-inflate, led by stocks with strong earnings growth like Dycom.

Recommended Action: Buy DY.