What impact will the latest Middle East conflict have on markets? One way to figure out is to go back and look at what markets did in every war in history and try to draw some conclusions about what they will do today. Unfortunately, there are no conclusions to be drawn. Every war is different, writes Jared Dillian, editor of The 10th Man.

There is a playbook for war: Gold goes up, oil goes up, commodities go up, and stocks don’t always go down. But that’s just in the early stages.

Early on in a war, there are fears of contagion, that the war will spread beyond borders and turn into something worse. And there are certainly fears of that today. The Ukraine war has been pretty much confined to Ukraine, which impacted wheat prices (though markets eventually adjusted). If Russia started lobbing missiles into Poland, I assure you that things would get more interesting.

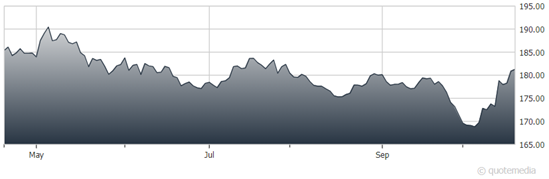

So, what do I think will happen? Well, gold has made some interesting weekly candles. Senator Lindsey Graham is talking about bombing refineries in Iran. We learned recently that we have had our last rate hike. I think the war greatly increases the probability that we’ll have a cut very soon, perhaps in the next few months. But I am just talking my book on all this stuff.

SPDR Gold Shares ETF (GLD)

As for the most recent conflict, it is a bad idea to use Ukraine as a model. With the Ukraine war:

- Gold peaked the night of the invasion.

- Wheat peaked shortly thereafter, along with other agricultural commodities.

- In fact, pretty much all commodities entered a bear market after the start of the war.

The thing about Wall Street is that people usually do what worked the last time without really thinking about what will work this time. Remember, every war is different. What’s unique about this one is that, well, it’s right in the middle of where all the oil comes from.

My job is to ask the dumb questions. If there were any danger whatsoever that things would spiral out of control in the Middle East, wouldn’t you want to own some oil? Just asking dumb questions here. If there were any possibility, however remote, that this could turn into a regional conflict, or even a World War, wouldn’t you want to own some gold? Just asking the dumb questions here.

Markets are hard, but they’re not that hard. Sometimes the dumb trades work. One thing I know about traders is that they overthink things way too much and tie themselves in knots.

Bonds are an interesting case. Bonds should rise during wartime because of a flight to safety, but everyone knows that rates have been going up on account of our massive deficits. So, what if we were to get involved in the war and our defense spending went up accordingly? What would happen to bonds?

Well, people like the certainty of bonds, especially when they pay big, fat yields. This is a basic decision theory problem—would you rather get a certain 5% or an uncertain 8% in the middle of a war? I think the question answers itself. I am not too worried that demand won’t meet supply in the bond market. Give it some time—people won’t get enough of them.