Long-term-focused advisors and analysts often counsel against attempting to “time the market,” rightly pointing out that no one has ever successfully been able to correctly call the market’s short-term directional changes with any accuracy. This is why I believe in bottom-up, long-term, buy-and- hold stock investing supported by sound portfolio diversification and management principles. One name I like is Fabrinet (FN), notes Douglas Gerlach, editor at Small Cap Informer.

Too often, investors put off portfolio decisions during bear markets or recessions, hoping that they will be able to buy at exactly the right moment when the market or economy shows signs of an upwards turn. Many investors often make the worse mistake of sitting on the sidelines during uncertain times, again with the intent of re-engaging with the market once the picture is “clearer.”

The risks of these misguided strategies hinge on the fact that without a crystal ball it is impossible to know exactly when a bear market or recession will end. And missing the bottom, even by a relatively few number of days or weeks, can cause an investor to miss out on much of the gains that they could have earned otherwise.

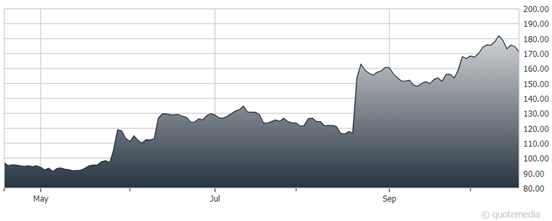

Fabrinet (FN)

As for FN, it reported fourth-quarter results that were better than the company’s guidance. Revenues were $655.9 million compared to $587.9 million in the prior year’s fourth quarter, a gain of 11.6%.

The company stated that revenues were driven by strong growth in datacom revenue that were boosted by new AI products. These gains more than offset headwinds from inventory adjustments at some telecom customers and flat revenue for optical communications.

EPS were $1.65, compared to $1.51 in Q4 2022, up 9.3%. For the fiscal year, revenues were $2.65 billion, compared to $2.26 billion in fiscal 2022, a gain of 16.9%. Cisco contributed 16% of revenue, followed by Lumentum at 15%, Nvidia at 13%, and Infinera at 12%. Fabrinet’s top 10 customers together made up 84% of revenues. EPS were up 25.6% to $6.73, from $5.36 for fiscal 2022.

Management provided guidance for Q1 2023, expecting automotive and industrial laser revenues to be relatively flat, and total revenues to be in the range of $650 million to $670 million. Seasonal near-term pressure on gross margins due to annual merit increases should hold EPS to be between $1.60 and $1.67.

Recommended Action: Buy FN.

Subscribe to Small Cap Informer here...