Food distributor Sysco Corp. (SYY) has a long history of steady dividends and regular dividend increases. It has paid a dividend every quarter since it went public in 1970. Though it faced severe headwinds during the pandemic, the forward outlook is also bright, notes Bob Ciura, contributing editor at Sure Dividend.

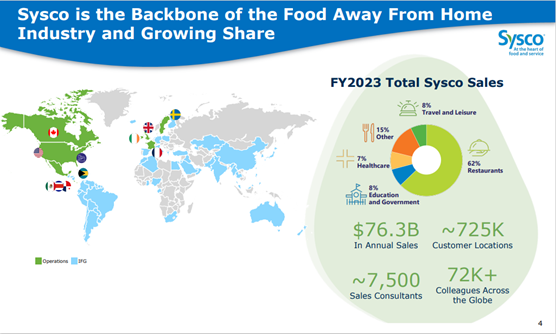

Sysco was founded in 1969 and went public the following year. In its first year as a publicly traded company, it had sales of just $115 million. The company has grown steadily over the nearly five decades since. In the 2023 fiscal year, Sysco had sales of $76.3 billion.

Today, Sysco is the largest wholesale food distributor in the US. It distributes products including fresh and frozen foods and dairy and beverage products. It also provides other products, including tableware, cookware, restaurant and kitchen supplies, and cleaning supplies.

The company has a wide range of customers, including restaurants, healthcare facilities, education, government offices, travel, leisure, and retail businesses. It also has a large segment of other customer types, such as bakeries, churches, civic and fraternal organizations, vending distributors, and international exports.

The operating climate for Sysco was challenged over the past two years as the coronavirus pandemic forced closures of restaurants and other dining venues that make up Sysco’s customer base. Also, supply chain issues across the country affected Sysco.

But on August 1, Sysco reported fourth-quarter results for Fiscal Year (FY) 2023. In the fourth quarter, Sysco achieved a 4.1% sales increase compared to the same period in the previous fiscal year, with US Foodservice volume rising by 2.3%. Adjusted EPS rose by 16.5% to $1.34, compared to the previous fiscal year.

For the entire fiscal year 2023, Sysco grew revenue by 11% with a 5.2% rise in US Foodservice volume. Adjusted earnings-per-share increased 23% to $4.01.

In our view, the combination of organic sales growth, acquisition-added revenue growth, and share repurchases is expected to result in 7% annual earnings-per-share growth.

In addition, Sysco had a recent dividend yield of 2.9%, which is a higher yield than the average yield of the broader S&P 500 Index. This leads to total expected annualized returns of 14.5% annually over the next five years.

Sysco should have little trouble increasing its dividend going forward. The company has an expected dividend payout ratio of 48% for fiscal 2024. This indicates that the dividend is sufficiently covered and should continue to increase over time.

Recommended Action: Buy SYY.