Over the past few years, there has been a lot of talk about emerging markets in the Asia-Pacific region, observes Jim Woods, a leading specialist in exchange-traded funds and editor of The Deep Woods.

One of those, India, with its robust gross domestic product (GDP) growth and desire to become increasingly industrialized, has captured the attention of many investors, who observe the progress that developing nations, such as India, are making to better the well-being of their populations.

After contracting following the COVID-19 pandemic, the economy of India has made a comeback with its projected GDP growth of 6.1% in 2023, according to the International Monetary Fund.

Following the UN projection news that the growing Indian population is expected to reach over 1.4 billion people, surpassing the population of mainland China, there has been a renewed interest in investing in this emerging economy, including from tech companies such as U.S.-based Apple (AAPL).

Other factors make India an emerging market with the potential to grow in the next few decades. Consider the progress made by the country on the front of increasing literacy rates from 40.8% in 1981 to 77% by 2023, alongside an increasing business education with six of 2023’s Financial Times Global Top business schools being located there.

Furthermore, factors such as the youth of the Indian population, the second largest digital literacy rate and the role of the English language give India a strategic edge in the increasingly interconnected world.

Indian ETFs allow investors to geographically diversify their global portfolio by owning companies trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India Ltd. (NSE). Currently, there are 14 Indian ETFs trading on the U.S. stock market with WisdomTree India Earnings ETF (EPI) being the second largest after iShares MSCI India (INDA).

With EPI reaching the AUM milestone of $1.1 billion, this might present investors interested in Indian equities with a great opportunity to enter the market. EPI’s focus on “old industries” means the fund remains fairly diversified, with its largest sectors being materials, energy and financials.

By investing in the fund, investors can gain exposure to broad, all-cap equity Indian companies, as well as use this access to Indian markets with a valuation-centric approach.

The WisdomTree India Earnings Fund seeks investment returns by tracking the price and yield performance of the WisdomTree India Earnings Index, which measures the performance of Indian incorporated and traded equities eligible for purchase by foreign investors.

Top holdings in the portfolio include Tata Steel Limited, Reliance Industries, ICICI Bank, Oil & Natural Gas Corp. Ltd., Infosys, Axis Bank Limited, Tata Consultancy Services, NTPC, Power Grid Corporation of India and Indian Oil Corp. Ltd.

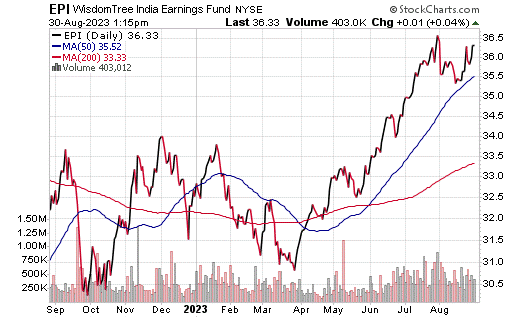

Chart courtesy of StockCharts.com

The fund is up 8.97% over the past three months and up 11.45% year to date; it has $1.1 billion in total assets under management, and it has an expense ratio of 0.85%.

EPI provides a great opportunity for global investors to expand their portfolio while investing in an emerging market, with a surging GDP. However, investors in this ETF should be aware of the potential currency fluctuation as well as political and economic uncertainty that might impact their investment.

Such investments in frontier markets like India have a tendency to be less liquid and efficient than those made in developed markets. Investors should always do their due diligence before adding any investment to his or her portfolio.