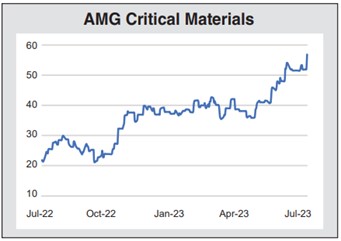

We first recommended the small-cap play AMG Critical Materials (AMVMF) in 2020. Since then, the shares have gained more than 200%. But the stock continues to meet our criteria as a small-cap value and growth play, writes Stephen Leeb, editor of The Complete Investor.

A doubling of revenues and tripling of gross profits have allowed a broad-based expansion from a company focused mainly on critical minerals such as graphite and highly refined silicon to one with three separate divisions: critical minerals, critical technology materials, and critical energy materials.

In all, there are 13 critical materials for which the company performs one or more services, including original sourcing, purification, refining, upgrading, and recycling. AMG’s guiding ethos is that “everything that can be recycled will be recycled.”

Its broad range of customers include major companies in energy, transportation, specialty metals, and infrastructure. All three divisions serve each of these sectors.

Its broad range of customers include major companies in energy, transportation, specialty metals, and infrastructure. All three divisions serve each of these sectors.

Within the energy materials division, the company mines, refines, and recycles vanadium, tantalum, lithium, and aluminum alloys.

Its critical minerals division mines and refines silicon, graphite, and antimony, while its critical technology division provides services to make titanium and chromium suitable for the markets they serve. For example, for chromium to be used in aerospace, it requires specialized coatings that allow the material to function at the high temperatures necessary for fuel savings.

Clearly this is a company that has taken full advantage of multiple niches created by multiple supply chain gaps within the industries most important to driving the circular economy. The numbers speak loud and clear.

From 2011 to 2020, earnings per share were highly erratic, bouncing from positive to negative and averaging about $0.30. Last year, driven by both rising revenues and soaring margins, earnings of $5.95 easily topped all-time highs.

We expect these trends to continue, though admittedly not at the same rate and with some volatility. Profits of at least $9.00 a share are within range by 2025-26. Going forward, growth should top 15%, possibly to the end of the current decade.

Recommended Action: Buy AMVMF