In 2011, entrepreneur and venture capitalist Marc Andreessen famously argued that “software is eating the world.” Twelve years later, that has proved prescient, although Andreessen likely underestimated how narrowly concentrated tech growth would be, writes Aniket Ullal, VP, ETF Data & Analytics at CFRA Research.

Large tech firms like Apple (AAPL) and Microsoft (MSFT) now have outsized weights in index-linked ETFs, driven by price appreciations of 49% and 45%, respectively, year to date through July 20. This necessitated a special rebalance of the Nasdaq-100 Index on July 24, where the weights of the index constituents had to be redistributed to prevent overconcentration in a few large-cap stocks.

The rebalance is symptomatic of two trends. The first is the short-term run-up in prices in 2023 of large-cap tech stocks like Nvidia (NVDA) due to enthusiasm around AI. The second is a multi-year trend of software-driven businesses accounting for a growing share of US stock market capitalization.

As of July 20, the Information Technology (IT) GICS sector accounted for a significant 28% of the weight of the SPDR S&P 500 ETF Trust (SPY). These trends have resulted in a few stocks having a disproportionately large weight in popular tech-heavy ETFs like the Technology Select Sector SPDR Fund (XLK) and the Invesco QQQ Trust (QQQ).

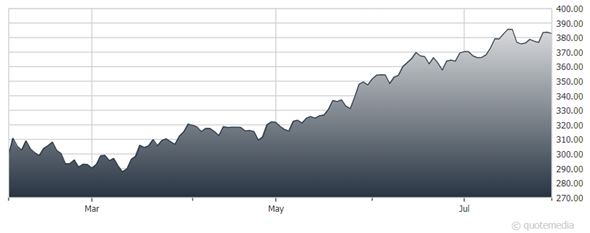

Invesco QQQ Trust (QQQ)

The goal of the special rebalance was to reapportion some of the weight of the largest constituents to other constituents to meet weighting threshold requirements. On July 14, Nasdaq released the pro forma weights, which projected that MSFT, NVDA, and Alphabet (GOOGL) would have the largest reduction in weight, with AAPL, Amazon (AMZN), Meta Platforms (META), and Tesla (TSLA) also likely to have weight reductions.

These changes impact the 16 ETFs tracking the Nasdaq-100 or a derived index, which had $260 billion in assets as of July 20. Indexed ETFs need to ensure that their funds continue to be diversified, sometimes necessitating rebalances in the underlying indices.

Active ETFs, especially those with a high active share (i.e., divergence from the benchmark), may find it more challenging to beat a benchmark where a small set of constituent stocks drive performance. However, it can also create an opening to appeal to those investors concerned about market cap weighted ETFs being concentrated in potentially overvalued large-cap tech stocks.

This segment of investors may look to mitigate that risk by considering “smart beta” ETFs, where stocks are selected and weighted based on fundamental factors. These investors may also consider going down the cap scale by investing in equal weighted ETFs or in mid-cap and small-cap ETFs.

Since 2018, S&P and MSCI, which jointly maintain the GICS framework, have reclassified technology stocks to accommodate their growing role in the broader economy. First, mega-cap stocks like META (then called Facebook) and GOOGL were moved from the IT sector to an expanded Communication Services sector in 2018.

More recently, stocks like Visa (V), Mastercard (MA), and PayPal (PYPL) were moved from IT to the Financials sector. If these stocks had not been reclassified away from IT, it is possible that the constituent holdings in SPY might have looked different, which also underscores how software is becoming embedded into the broader economy and how it is “eating the world,” as Andreessen stated in his widely read 2011 blog post.