The news in June that the S&P 500 had finally emerged from bear territory was good news for many investors, and the bulls were happy to return to small-caps as well as large-caps. Interest in small-caps was so strong that investors pushed the S&P SmallCap 600 from negative YTD territory at the start of June back into the green. One company I like is Century Communities (CCS), writes Doug Gerlach, editor of SmallCap Informer.

Dale Francescon, Chairman and Co-CEO of Century, said of the company’s second quarter results: “We are pleased with the strong sequential gains across our business including substantial increases in net new home contracts, starts, deliveries and gross margins.”

When management leads with sequential quarter comparisons, this often means year-ago quarter comparisons will be disappointing, and this holds true in this case. Total revenue for Century Communities dropped 28% from $1,166.1 million for Q2 2022 to $884.2 million in Q2 2023.

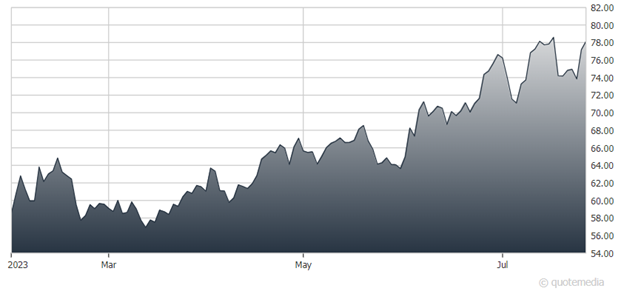

Century Communities (CCS)

Home deliveries were down in all categories with an average decrease of 17.6%. Average selling price also dropped an average of 12.4% from Q2 2022 figures.

There was some good news in the report. Net new contracts increased from Q2 2022 by an average of 3.8% in all reporting areas. Three of four geographical regions saw decreases, but net new contracts grew by 20% in the Texas region and by 16% in the Century Complete style category. (Century Communities breaks out data by four geographical categories and the Century Complete style category.)

With fewer homes delivered and lower average selling prices, earnings took a big hit. EPS plunged 67% from $4.78 in Q2 2022 to $1.60 for Q2 2023. But comparison was going to be hard as Century had record years in 2021 and 2022. Excluding 2021 and 2022, the current EPS results are slightly above the long-term trend for EPS.

Century Communities appears to be managing inventory and debt well in this challenging environment. Notes payable have increased only 1% since the end of calendar year 2022 while value held in inventory has increased just under 1% in the same time period.

Management is optimistic as the board of directors maintained the dividend and FY 2023 guidance was increased to estimate home deliveries to be in the range of 8,300–9,000 homes and total revenues to be between $3.1 billion and $3.4 billion.

Recommended Action: Buy CCS.