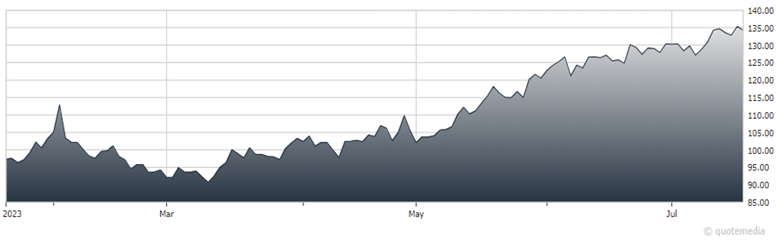

Editor’s Note: Matthew Timpane, senior market strategist at Schaeffer’s Investment Research, also had the eighth best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The ecommerce and cloud computing giant Amazon.com (AMZN) produced a total return of 49.2% during the tracked period. I reached out to him recently for updated commentary and guidance on his “Terrific Ten” stock, and this is what he provided...

Now that we’re through the first half of the year, there’s no shame in taking some profits up over 50%, especially as the stock stretches from its 200-day moving average and could consolidate. Watch and see how Amazon also handles its 50-day moving average, a trendline connecting March and May lows. You may want to reduce your position if it breaks below the 200-day, as a test could be in the cards.

Large options traders are targeting more upside for Amazon, with the September 135- and 145-strike calls popular, as well as the October 130- and November 150-strike calls.

Amazon.com (AMZN)

From a macro perspective, supply chains are normalizing and wage inflation is subsiding, as investors are now looking for improved margins, a catalyst we identified back in December. Amazon beat first-quarter expectations with 9% year-over-year growth and increased artificial intelligence (AI) adoption could produce a new wave of Amazon Web Services integration.

Many positives around the stock remain, but we’d take some risk off the table—especially with that 200-day moving average lingering. We do want to maintain exposure for any more potential upside into year-end, though, especially with large option traders targeting a move above the $150 level—creating potential for another 20 percent of upside.

Options traders will be pleased to know that AMZN has rewarded option buyers over the past year. The equity’s Schaeffer’s Volatility Scorecard (SVS) comes in at 77 out of a possible 100, meaning AMZN has handily exceeded options traders’ volatility expectations in the past 12 months. The stock’s SVS sat at 88 in December.

Recommended Action: Buy AMZN.