Editor’s Note: Jim Osman, editor of The Spinoff Report Lite, had the sixth best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The industrial technology company Vontier Corp. (VNT) produced a total return of 51.2% during the tracked period. I reached out to him for updated commentary and guidance on his “Terrific Ten” stock, and this is what he provided...

VNT, formerly part of Fortive Corp., is a global industrial technology company focused on transportation and mobility solutions and operates primarily in three segments:

1) The Mobility Technologies segment offers digitally enabled equipment and solutions for the mobility ecosystem, including point-of-sale systems, fleet telematics, electric vehicle charging software, and alternative fuel dispensing solutions. VNT is the #1 integrated technology provider to the car wash industry in US with 17k sites.

2) The Repair Solutions segment includes the Matco business, which manufactures and distributes aftermarket vehicle repair tools and diagnostic equipment.

3) The Environmental & Fueling Solutions segment provides environmental and fueling hardware, software, and aftermarket solutions for fueling infrastructure worldwide.

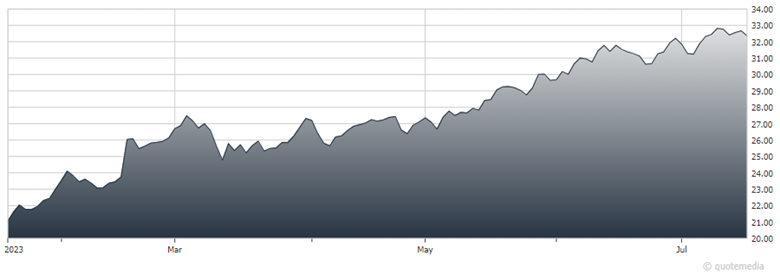

Vontier (VNT)

The company’s major focus is on providing solutions to lead the evolution of the mobility ecosystem. To focus on the mobility ecosystem, VNT divested its Global Traffic Technologies, LLC (GTT) business to Miovision for $107 million in April 2023, at a transaction value of ~10x 2022 EBITDA. The proceeds from this divestiture will be utilized to reduce debt and return capital to shareholders through additional share buybacks ($50 million allocated for debt repayment and $50 million for share repurchases).

Also, in July 2021, VNT acquired DRB Systems, LLC for ~$965 million, solidifying its position as a leading provider of point-of-sale, workflow software, and control solutions in the car wash industry.

Management highlighted in the Q1 23 quarter that DRB’s performance in the mobility technologies sector has been impressive, with strong growth of over 20% as they expand their market share in the lucrative tunnel car wash industry. With 17,000 sites, VNT holds the top spot as the integrated technology provider to the car wash industry in the United States. DRB Systems is projected to achieve a 10% ROIC and mid-20% operating margins within five years.

Meanwhile, VNT is actively managing its leverage, with a current Net Debt/Adjusted EBITDA ratio of 3.1x in 1Q23, which is targeted to be reduced to ~2.5-3.0x. Management has plans to pay down ~ $200-250 million of debt in 2023, Currently, the company’s gross debt stands at $2.5 billion. VNT is up by ~80% since September 2022 and is trading at 9.4x 2024 EV/ EBITDA with leverage of 3.2x.

Recommended Action: Buy VNT