As we’ve often said, when the markets change, we have to change with them. Now, the stock market is bullish. It’s set to rise further. And at this point, you want to own stocks, explain Mary Anne and Pamela Aden, editors of The Aden Forecast.

The stock market has actually been rising since last October. That’s when it hit its bear market low, following a nine-month decline. That decline spooked a lot of investors and they’ve been gun-shy ever since.

The “up” move this year also caused concern about the validity of the rise because it was being driven by only a few of the big tech stocks. The rest of the market wasn’t really participating and many stocks were volatile. Along with recession signs, these factors fueled uncertainty.

But then things changed…and OTHERS JOINED IN. Most of the other stock indexes surged higher as well, following Nasdaq, which has been the leader. This was impressive, especially considering that despite interest rate rises, bank failures, and the debt ceiling standoff, the stock market held its own and then the others joined in.

But then things changed…and OTHERS JOINED IN. Most of the other stock indexes surged higher as well, following Nasdaq, which has been the leader. This was impressive, especially considering that despite interest rate rises, bank failures, and the debt ceiling standoff, the stock market held its own and then the others joined in.

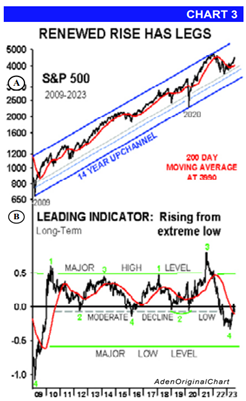

Plus, our leading indicators nearly all turned up, reinforcing a solid bull market and underscoring that stocks are indeed headed higher.

A reminder…the stock market looks ahead by about 6-9 months. It doesn’t look back. So, the fact that stocks are rising is a strong signal that the market sees better economic times ahead.

Okay, but what about the inverted yield curve and the other signs pointing to a recession downstream? We can’t argue with them. These signs are reliable and they’re real.

But when a market signals a new bull market is underway, rarely is the environment perfect. The markets have the final word. And for now, they’re signaling that it’s time to change our strategy. That is, a stock position is now recommended with at least a 15% position of your total portfolio for starters.

To keep it simple, we advised recently to buy the two ETFs of the strongest indexes…the Invesco QQQ Trust (QQQ) and the S&P 500 ETF Trust (SPY). These will head higher in tandem with the Nasdaq and the S&P 500. And if the bull market says on track, we’ll likely increase our position in common stocks.

Recommended Action: Buy QQQ and SPY