Investor sentiment in the first six months of 2023 was dominated by macro uncertainties, such as the regional banking crisis, rate hikes by the Federal Reserve, and persistently high inflation. The overhang from some of these issues continues to persist and flows into ETFs this year have been relatively muted, explains Aniket Ullal, VP, ETF Data & Analytics at CFRA Research.

Despite the macro headwinds, the equity market received a boost from the strong performance of AI-related stocks. But it is important to note that market leadership in the equity markets was quite narrow, as a few mega- and large-cap tech stocks accounted for the bulk of the strong performance.

And while performance in US equity markets has been strong, flows into ETFs this year have been relatively subdued. In 2022, equity ETF investors added almost $294 billion of new money. Through May 2023, equity ETF inflows were $61 billion.

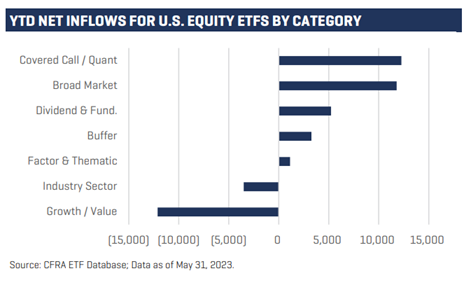

A closer analysis of this year’s equity ETF inflows shows that investors have rotated into dividend and fundamental, covered call, and buffered strategies. ETFs that use dividends and related fundamental factors in their security selection and weighting methodology accounted for $5.2 billion in net inflows.

Covered call and other options-based quantitative strategies continued to be popular in 2023 as well, with the category taking in $12 billion. Investors also favored the buffer structure (sometimes referred to as defined outcome), with that product type taking in $3 billion in net flows.

By contrast, investors rotated out of industry-focused and growth- /value-focused ETFs. Growth and value ETFs had outflows of $12 billion this year through the end of May. CFRA data shows the bulk of these outflows were concentrated within a handful of ETFs, mainly the iShares Russell 1000 Growth ETF (IWF) and the iShares Russell 1000 Value ETF (IWD), which had $4.6 billion and $5.2 billion in outflows, respectively.

As equity investors pivoted away from growth stocks and with rising rates impacting bond investors, cash-rich companies were well-positioned to attract investors focused on generating income. The dividend component of total stock performance has returned into focus, and dividend ETFs remain one of the largest smart beta categories within the equity ETF space, with over $325 billion in total assets in the US.