“This is a once-in-a-generation moment for nuclear energy!” That statement was made by Maria Korsnick, president and CEO of the Nuclear Energy Institute. I believe Korsnick is correct, but my primary perspective is as an investor. To profit while avoiding single-stock risk, consider the Sprott Uranium Miners ETF (URNM), writes Sean Brodrick, editor at Weiss Ratings Daily.

Uranium stocks were beaten down for so long, but there is plenty of low-hanging, contrarian fruit just waiting for fast-moving investors to grab. It’s a once-in-a-generation moment, indeed!

Here are some facts:

- Nuclear power provides about 20% of America’s electricity. What’s more, in 2022, atomic power was responsible for 47% of America’s carbon-free electricity. That makes it the largest domestic source of clean energy.

- Nuclear power is more reliable than any other power source, with power plants running at full capacity more than 92% of the time.

- Around the world, global electricity demand is surging — up a whopping 6% last year alone. The forecast is for global electricity demand to rise 2.7% per year. Solar and wind will only get you so far. And that means we either build nuclear, or we build more coal-powered plants.

- Russia’s invasion of Ukraine has also thrown a shadow over uranium. Russia accounts for 13% of the global supply of uranium and 40% of the global supply of enriched uranium, and now the civilized world doesn’t want to buy from Russia anymore. Neighboring Kazakhstan’s uranium supply (45% of the global total) is under Russian domination. For security reasons, the world needs alternate sources of uranium.

In fact, 2022 saw European utilities buy more uranium than they loaded into reactors — the first time that happened in more than 10 years, according to World Nuclear News. The Europeans are obviously worried about Russia choking off their uranium supply. So, they’re building up inventories.

That’s why we are seeing volumes pick up in the uranium spot market. And that extra buying means prices are going up, too. The spot price of uranium pushed up to $55.75 recently. That’s a new 52-week high.

You can profit by buying individual uranium miners. But URNM is an alternative that holds a basket of leading uranium miners and charges an expense ratio of 0.85%. It even has a dividend yield of 1.76%.

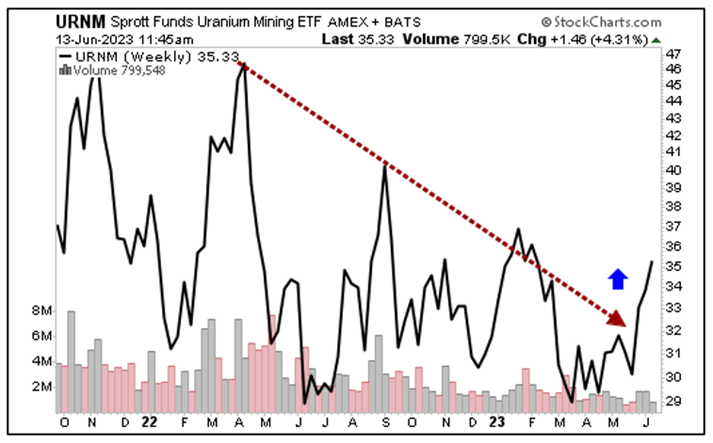

And as you can see on its weekly chart, URNM is breaking out of a long downtrend:

With that kind of breakout, my initial target on URNM is $50 a share.

Recommended Action: Buy URNM.