Those expecting a “dovish” skip at the Fed meeting may have been surprised by an increase in the expected terminal rate presented in the dot plot. But while markets may be overbought, it would not surprise me if they stay pinned for a bit to force people out of their bunkers and back into stocks, remarks Tom Hayes, founder of Hedge Fund Tips.

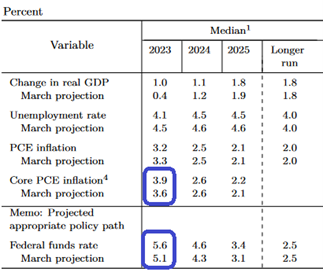

At its recent meeting, the FOMC took the terminal rate projections up to 5.6% from 5.1% – implying two more hikes. Nick Timiraos (WSJ “Fed Whisperer”) called their bluff in the press conference and asked why – if they are so hawkish – didn’t they simply pull the band-aid off and hike at this meeting?

Powell’s general tenor was that July is a “live meeting” but projections could change (i.e. the dot plot is designed to ANCHOR inflation expectations, not kill inflation). Now that expectations are back at 2018 levels, I would say it is working:

The biggest risk is no longer inflation moving forward. The biggest risk is deflation. You cannot have debt to GDP at ~120% and enter deflation. The ONLY play is to inflate your way out of it and run inflation above 3% for 3-5 years – as we did following WWII – when we had similar debt levels.

I recently said, “While I wouldn’t be surprised by some short term market consolidation, I also wouldn’t be playing for it.” Quite a few names are “overbought” and many of the short-term indicators I look at point toward taking a breather. However, at the same time, when I see positioning and sentiment so low I remain open-minded to the idea we could stay pinned for some time and push more people into the market against their will!

Meanwhile, Bank of America recently published its monthly “Fund Manager Survey.” Here were the five key points:

1) Only 15% of managers expect stronger economic growth. These are levels not seen since the Pandemic low, GFC lows, and Tech Wreck lows in 2001.

2) Managers are taking the lowest levels of risk in their portfolios since early in the 2009 recovery

3) Equity allocations are still 2.1 standard deviations below their long term average despite a ~25% rebound off the October lows.

4) Managers remain overweight bonds and underweight equities relative to 20-year average.

5) The most crowded trades are “Long Big Tech” and “Short China”. We expect the relative performance to flip. Big Tech will under-perform China in 2H.