Citigroup (C) is the third-largest lender in the U.S. and the least-loved major bank by investors—for good reason. The bank has been a chronic poor performer seemingly forever. But changes at this disliked bank are now creating some great opportunities for investors, notes Tony Daltorio, editor of Investors Alley.

Changes began to happen after Jane Fraser became CEO in March 2021: she set about divesting Citi of much of its global consumer banking franchise, which had no synergies with its best businesses: Transaction banking, credit cards, and fixed-income markets.

The changes she made are already starting to bear fruit. On April 14, Citigroup reported a profit of $4.6 billion in the first quarter, up 7% from a year earlier and well ahead of the expectations of Wall Street analysts. Revenue jumped 12%. Citi’s loan book was roughly unchanged, and deposits fell 3% from the previous quarter, though credit card lending was up 7% from a year earlier.

However, UBS analysts said Citigroup still had “more wood to chop”—and the bank has proceeded to do so.

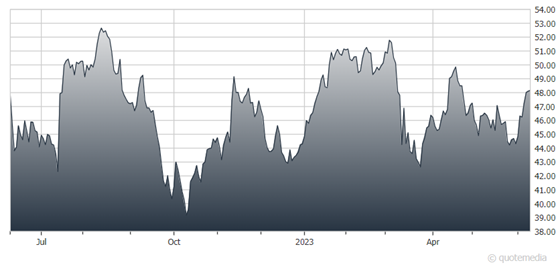

Citigroup (C)

On May 24, Citi said it will spin off its Mexican retail bank (Banamex) through an initial public offering, abandoning a plan hatched early last year to sell the unit to another bank instead.

Banamex is one of the largest consumer banking franchises in Mexico. Citi said an IPO of the unit was likely by the end of 2025. Despite the spin-off, Citi does plan to retain much of its corporate and institutional business in Mexico.

At the time of this announcement, the bank also said it would resume stock buybacks by the end of June—at least six months sooner than analysts expected.

In other words, Fraser is doing all the right things to turn Citi around. Yet, neither she nor Citigroup shareholders have yet been rewarded for doing the right things.

Citigroup stock has continued to underperform the other big, diversified US banks, and its valuation remains largely unchanged. In fact, Citi’s price to tangible book value ratio is still edging down—to $0.54—as of June 2.

So, what is the problem? Despite all she has done, Fraser still has a lot to do. The numbers don’t lie…

Citi’s return on tangible common equity (8.9% in 2022) is lower than it was in 2019. And the gap with its big banking peers is still in the mid-teens, and has not narrowed. None of the divestments or other reforms so far have moved the needle.

But Citi is moving in the right direction. Jane Fraser is streamlining the bank, especially the planned exit of consumer banking in Mexico and the ongoing sales of its Asian retail banking units.

These actions will release equity capital that can be redeployed to the company’s leading position in corporate treasury services, financial technology platforms, and expanding global wealth management business that has new leadership.

Recommended Action: Buy C