Value or growth? It’s an important question, especially after seeing some of the big tech stocks pop after better-than-expected earnings in the last couple of weeks. It’s important to remember that if our economic outlook is correct, we are currently in the middle of an extended period of higher interest rates. Artisan Value Fund (ARTLX) is a fund I like as a result, notes Brian Kelly, editor of Money Letter.

Without the ultra-low interest rates that companies have gotten used to, growth stocks are less attractive (well, maybe not the FAANGs like Facebook, Alphabet, Apple etc.). Cheap debt helped lower-quality companies prosper…and that is no longer the case.

Higher-quality companies with lower stock prices can survive an economic downturn and gain market share while smaller growth companies struggle. We recently came across the story of Lithia Motors, an Oregon-based chain of automobile dealerships. Lithia has the largest inventory of cars for sale online in the US.

It has been undervalued because of the threat of recession and the worry that demand for cars will decline. As the Motley Fool pointed out, legendary value investor Bill Nygren (Oakmark Select) has held this stock even though its earnings appear to make it a “growth” stock. Its price-to-earnings ratio – because of the macro-economic outlook – made it an unlikely but profitable value play.

ARTLX is a recently recommended fund of mine. Per fund managers Artisan Partners, it focuses on cash-producing business in strong financial condition that are selling at undemanding valuations.

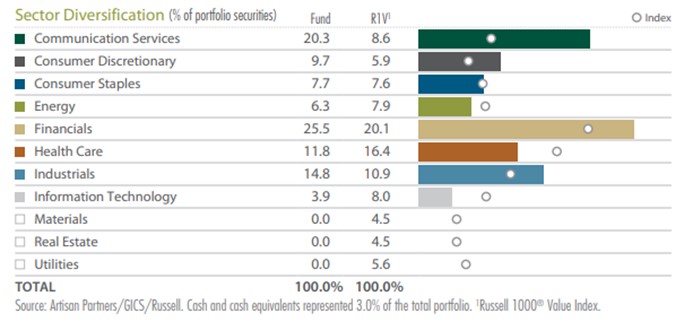

ARTLX Sector Exposure (as of 3/31/2023)

Meanwhile, all subscribers should maintain their asset allocations given our intermediate (6-12 month) outlook for peaking inflation, peaking interest rates, and a soft landing for the economy. We expect volatility in the equity markets to continue until we get more confidence in the trend and speed of disinflation and clearer signals from the Fed.

Through four months, our models are all positive and have returned between +2.2% (Vanguard Conservative) and +5.9% (Fidelity Venturesome). Bond and money market funds are contributing to returns. Most bonds are less risky alternatives to stocks right now, especially with the likelihood of interest rates peaking soon.

Recommended Action: Buy ARTLX

Subscribe to MoneyLetter here...