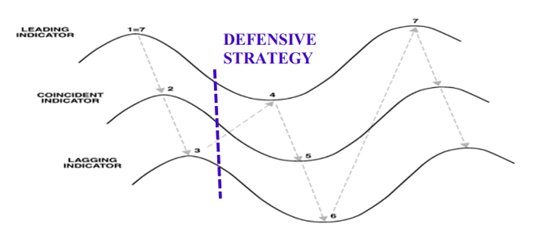

The long-term outlook for the stock market remains cautious. The business cycle is in phase 4. This is the time when earnings decline. But bonds and gold remain attractive, which is why I just invested 2% of the model portfolio in the SPDR Gold Shares ETF (GLD), says George Dagnino of Peter Dag Strategic Money Management.

I watch TV after dinner - but not the cable programs. I select the YouTube app and, using the microphone option on the Roku remote, I search for financial podcasts. They cover a wide range of subjects, posted by analysts rarely seen on TV.

However, some of them explore unique issues and add new perspectives. It is fascinating how television and technology have developed ways to meet the interest of many special groups. YouTube remembers my choices and shows the podcasts that interest me.

My reaction? Free speech is alive and well. This platform provides an excellent stage to be exposed to different subjects and opinions.

As for the markets, the business cycle is slowly and inexorably declining, pointing to slower growth. The trend has been in place since mid-2021 and it will last into 2024. Investors need to focus on its direction not on the noise surrounding it.

When the economy slows down, interest rates peak, commodities peak, inflation peaks, inventories are being cut, and the money supply slows down. Credit conditions also tighten.

The next bull market will start after a decline of several months in short-term interest rates. The yield curve will flatten with the 2-year Treasury yields rising above the 10-year Treasury yields. The percentage of stocks below their 200-dma will decline to levels always associated with major market bottoms.

Until then, stick with bonds and gold.

Recommended Action: Buy GLD.