CVS Health Corp. (CVS) is a healthcare leader and the sixth-largest US company by sales. It’s trading at a record low valuation, despite solid growth and a strong outlook, making it a buy, argues Adam Johnson, editor of Bullseye Brief.

Some of the highest-quality companies in the US are trading at their cheapest valuations in years. Big banks are down. Big Tech is down. And now one of the nation’s biggest healthcare companies is down too…25% since January.

The malaise among investors is palpable, and I think we need to remind ourselves that these are the moments when we buy. True, we may want to save some ammo for any further potential declines, but building positions in high-quality companies when their stocks are down is how thoughtful, long-term investors build wealth.

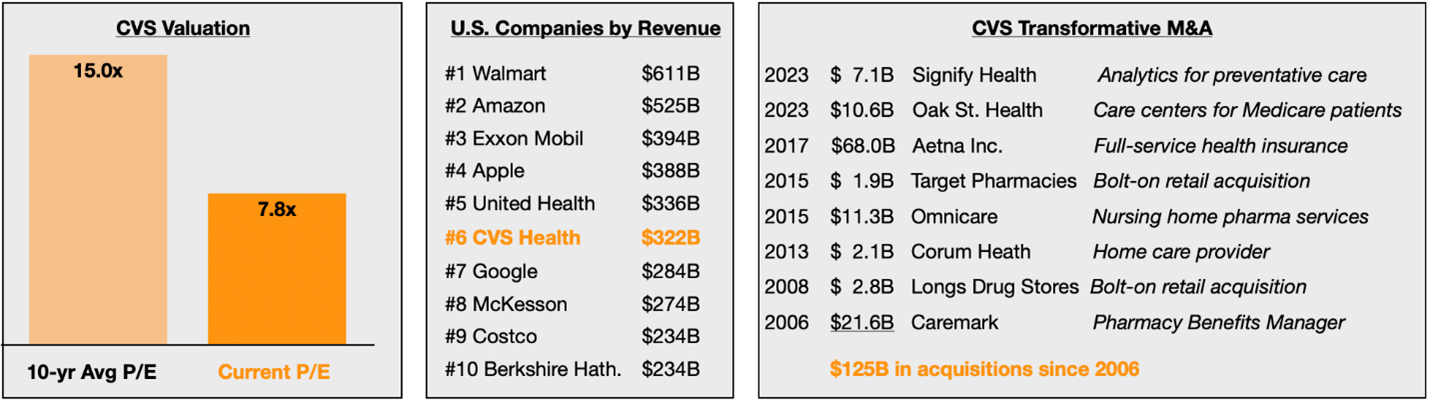

CVS has grown into the nation’s sixth-largest company by sales, a $340B per year healthcare platform providing health insurance, specialty benefits, walk-in clinics, in-home treatment, preventative care and retail pharmacies. Through a series of transformative mergers over several years, management has successfully expanded from narrow retailer to full-service provider, while generating consistent earnings growth year after year.

Incredibly, the stock trades at just eight times earnings, less than half the multiple of the S&P 500 and its cheapest valuation in 20 years. In fact, it’s even cheaper than during the Covid plunge of 2020. By comparison, United Health Group (UNH) trades at 20x earnings.

I think the discount reflects market perception of a less-focused enterprise, and one which needs to prove it can integrate $17B of new acquisitions closed in recent weeks. Fair point, but I’ll happily buy a market leader trading on the cheap…especially in light of consistent growth, a proven C-suite and a 3% dividend yield.

Cheap, Big, and Getting Bigger, CVS Stands Out

CVS beat analyst estimates across the board in its Q1 results announced May 3. Specifically, topline revenues rose 11% YoY to a new all-time high of $85B, $5B ahead of estimates and resulting in a 5% earnings beat.

Looking forward, management raised full-year sales guidance by 4% but lowered earnings guidance by 1%, saying 2023 profits will be flat with last year due to the added costs of integrating recent acquisitions.

Recommended Action: Buy CVS